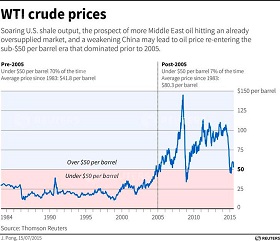

Recent reports released by analysts suggest that the situation in the oil market, already highly volatile, could get much worse in the near future. Morgan Stanley in particular argues that the oil crash that we are witnessing now may be even worse than the oil glut of 1986. In December that year oil prices fell from $23.29 to $9.85 sparking chaos in the markets throughout the globe. Some even argue that the 1986 oil crisis predetermined the collapse of the Soviet Union.

Recent reports released by analysts suggest that the situation in the oil market, already highly volatile, could get much worse in the near future. Morgan Stanley in particular argues that the oil crash that we are witnessing now may be even worse than the oil glut of 1986. In December that year oil prices fell from $23.29 to $9.85 sparking chaos in the markets throughout the globe. Some even argue that the 1986 oil crisis predetermined the collapse of the Soviet Union.

Analysts draw parallels between the oil price dynamic in 1986 and 2015 based on similar trends that prevail in the market at the time. OPEC’s decision to sustain daily oil output over supporting the price of crude is one of such factors. Analysts also single out rising volatility and falling US Treasury yields as other contributing factors.

In theory the global oversupply of oil should correct itself as low oil prices force investment in new drilling capabilities down, but this time the major oil producer OPEC has instead increased output by about 1.5mln bbl per day since February, an amount equal to year’s increase in global demand. Russia also stepped up its daily production to 10.713mln bbl setting a post-Soviet output record.

Now that a nuclear deal has been reached the level to which Iran’s oil production will grow causes most concerns among experts. Iran has stated that once sanctions are lifted the country could increase its oil exports by one million barrels from 1.2mln bbl a day to 2.3mln bbl, which constitutes 1% of global production. It is likely, however, that the effects of this dynamic on the oil market will be minimal.

Iran’s plan is to return to the pre-stations level of production of about 3.5mln bbl a day, which will take several years, as well as significant investment that Tehran needs to attract from the West. The impact of this change on the oil price will be gradual or even muted because major producers expect this change and will certainly adjust to it.

One of the key differences between the situation in 2015 and that in 1986 is that now OPEC has filled its onshore and offshore oil storage and doesn’t possess a significant amount of spare capacity. Oil storage available to producers now is equal to about 2% of total supply, while in 1986 it amounted to 30%.

Iran, the player whose possible daily output causes a lot of concern, also has its storage filled. The country has accumulated 10 mln bbl of crude in onshore and offshore facilities. This oil is likely to go onto the market first once the sanctions have been lifted. This may cause temporary volatility in the market, but is not enough to cause a 1986-type crisis in the oil industry.

Once the energy sanctions against Iran are lifted, which may happen as soon as in November, the country’s goal will be to empty existing storage facilities to revitalize the cash-strapped economy. But at a time when Tehran needs to sell oil at its pre-sanctions price it is unlikely to dump all of it into the market causing another price shock.

Morgan Stanley, however, forecasts that we are more likely to see an increase in oil prices before the hypothetical 1968-type oil slump occurs. Since OPEC producers have almost filled their existing storage they are unlikely to keep ramping up production. National budgets of OPEC members are now critically dependent on the price of oil. Saudi Arabia, for example, had to issue first sovereign bond since 2007 to cover the budget deficit caused by cheap oil.

Even though OPEC says it intends to maintain the output ceiling to defend its share of the market and that low oil prices is a short-term development, they soon may be forced to start negotiating a coordinated cut in oil production.

As of now excess crude production around the world amounts to about 800 thousand bbl a day. At the same time JP Morgan argues that the decision to maintain oil production at 31mln bbl a day will cost OPEC $200bn a year. Saudi Arabia alone stands to lose over $90bn a year.

It seems, however, that Riyadh’s policy is gradually changing. Instead of saying that Saudi Arabia will not cut production the country’s officials argued that OPEC and such producers as Russia would need to bear the burden of a cut together just like it was in 1986 and 1998.

All in all it does seem that global oil producers understand the imminence of a crisis if their policies remain unchanged. Even though a 1986-type slump may be a slightly far-fetched forecast, recent events show that volatility in the oil market pursues. Hence, we may soon witness attempts by global crude producers to bridge their differences and work out a win-win strategy for keeping oil price high as well as production at mutually agreed levels.