Bahrain: A Small Country with Big Opportunities?

Bahrain stock market, Manama, Bahrain

June 26, 2016

In

Login if you are already registered

(no votes) |

(0 votes) |

Ph.D., Assistant Professor, Peoples’ Friendship University of Russia

Economic sanctions are making Russian entrepreneurs look more carefully in pursuit of more favourable development opportunities. The Kingdom of Bahrain calls all the shots among the states in the Gulf and offers effective ways for cooperation with Russia. The financial capital city of the Arab region encourages private entrepreneurship by fully removing capital export restrictions and eliminating customs duties on the import of equipment and raw materials. Bahrain’s business environment is characterized by the openness of its economy, high international rankings in terms of economic freedom, and financial development indices. Will the Russian side manage to see the “pearl” of the Arab world and fully unlock the potential of their bilateral commercial and economic relations?

Economic sanctions are making Russian entrepreneurs look more carefully in pursuit of more favourable development opportunities. The Kingdom of Bahrain calls all the shots among the states in the Gulf and offers effective ways for cooperation with Russia. The financial capital city of the Arab region encourages private entrepreneurship by fully removing capital export restrictions and eliminating customs duties on the import of equipment and raw materials. Bahrain’s business environment is characterized by the openness of its economy, high international rankings in terms of economic freedom, and financial development indices. Will the Russian side manage to see the “pearl” of the Arab world and fully unlock the potential of their bilateral commercial and economic relations?

Specific Aspects of Bahrain’s Economic Development

The discovery of oil deposits in 1932 was a turning point in the economic and social life of Bahrain and has had a considerable and comprehensive impact on the country’s contemporary development. At present, the oil and gas sector takes up a large share in Bahrain’s GDP structure, 22 per cent in 2014.

Today, Bahraini industry (with the exception of the oil and gas industry) takes up 14.5 per cent of the country’s GDP. The most important industries include aluminium production (960,643 tonnes per year) [1], and ship-repairing. Aluminium Bahrain (ALBA) is one of the largest aluminium-producing companies in the world. The company is of strategic importance for the country’s economy, as it takes up approximately 12 per cent of the GDP, and 51 per cent of its products are exported. ALBA’s production facilities are planned to be extended by 2019 (thanks to an investment of $3.5 billion), an increase in the industrial companies’ share in the country’s GDP should be expected.

In 2014, the financial sector’s contribution to the GDP amounted to 17 per cent. Although it ranks second after the oil and gas industry, since 2011, the financial sector’s role in the country’s economy has been downgraded considerably (in 2010, financial services made up 25 per cent of Bahrain’s GDP). The financial market shrank as a result of social instability, which brought about a deterioration of the macroeconomic situation in general and decrease in Bahrain’s attractiveness for international business in particular. The continuing growth in oil prices over the past several last years has led to a decrease in the share of the financial services in the economy, and thus an increase in the role of the oil industry.

Bahrain’s competitive advantages on the regional and global scale are its open economy, its liberal economic policy and promotion of private enterprise.

Institutional investment is a relatively new, but rapidly developing area. Since 2007, hedge funds and other equivalent financial institutions have been operating directly from Bahrain. Funds may be established as investment trust companies or an SPV (special purpose vehicles). Now there are 2,650 funds with a net asset values of $7.5 billion.

Bahrain’s stock market is characterized by a high concentration of assets held by comparatively few players. In July 2016, market capitalization amounted to $18 billion [2], which is almost three times more than in 2000. Despite the positive dynamics, Bahrain’s stock market is still the smallest in the region and needs being further developed by increasing the number of liquid instruments and investors.

In general, the Bahraini economy had been developing dynamically until 2015. In 2014, the country’s GDP reached $33.4 billion, an increase of 16 per cent from 2011. In 2015, growth rates slowed down due to a decrease in oil prices on the global market, resulting in a contraction to $31.8 billion. Despite all efforts to diversify the economy, the oil and gas industry still takes up the largest share of the state budget (88 %) and foreign currency proceeds from foreign trade operations (67 %). Therefore, it encourages further transformations in the economy.

Bahrain’s Role in the Global and Regional Economy

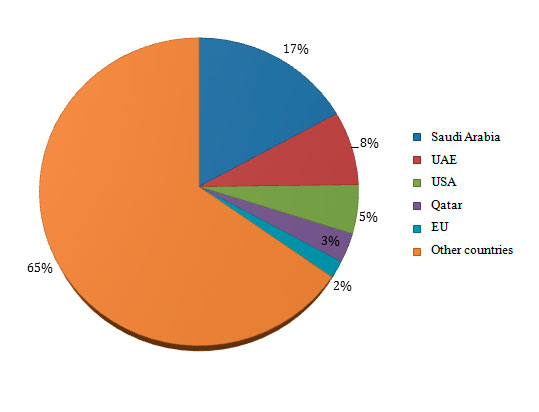

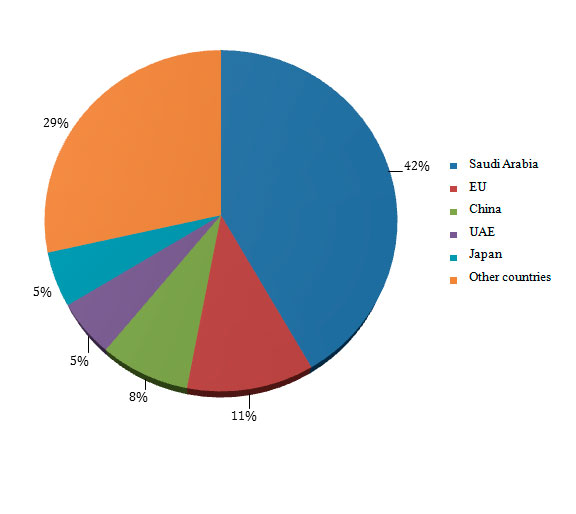

Bahrain has a wealth of experience in international economic cooperation. Its key trade export partners are Saudi Arabia, the United Arab Emirates, the United States, Qatar and the European Union. The leading importers into Bahrain include Saudi Arabia, the European Union, China, the United Arab Emirates and Japan (Figs. 1 and 2).

Saudi Arabia, Qatar and the United Arab Emirates are Bahrain’s main trade partners within the Cooperation Council of the Arab States of the Gulf (Gulf Cooperation Council, GCC). Bahrain has special ties with Saudi Arabia. The joint oil exploration in the Abu Safah offshore field is a prime example of this. Almost a half of Bahrain’s supplies to the oil monarchies of the Gulf go to Saudi Arabia.

Bahrain is the only country in the Gulf that imports crude oil, with the share of crude oil in the import structure exceeding half of all imported goods. The capacities of oil processing plants are used to process imported oil supplied by Bahrain through the Dammam underwater oil pipeline, and then to export products. For instance, in 2011, crude oil made up 62 per cent of the country’s import structure, and oil products constituted 75 per cent of its the export structure. In 2014, oil products made up 38 per cent of the country’s export structure.

It should be noted that Bahrain is the only one of the six GCC countries with a positive services trade balance ($1.742 billion in 2015), which demonstrates a high level of development of financial, tourist and transportation services.

Bahrain was the first country in the region to sign a Free Trade Agreement with the United States. According to the Minister of Industry and Commerce, Hassan Abdulla Fakhro, the Free Trade Agreement with the United States brings $1.3 billion to the Bahraini economy annually [3]. The United States, along with the European Union and other countries in the region, is among Bahrain’s five leading trade partners in terms of import.

Bahrain’s net international investment position shows a surplus of $26.7 billion, with $167.7 billion in assets and $173.4 billion in liabilities. The inflow of foreign direct investment into the country in 2014 amounted to $19 billion, with an outflow to $11 billion. Bahrain Mumtalakat Holding Company was set up in 2006 and is entrusted with the functions of a sovereign wealth fund, that is, strategic investments and asset management. Mumtalakat has investments in more than 40 companies in Bahrain and abroad to the tune of $7.2 billion. The majority of its foreign investments is in the Gulf countries and other Arab states.

Bahrain’s investment cooperation with its GCC partners covers strategic areas of the economy. In the oil and gas sector, 12.5 per cent of the company BANAGAS belongs to the Kuwaiti Boubyan Petrochemical Company. Saudi Basic Industries Corporation and the Kuwaiti Petrochemical Industries Company own equal shares in Petrochemical Industries Company (GPIC) (one-third each). Mubadala Development Company from the United Arab Emirates owns 32 per cent in Tatweer Petroleum [27] [4]. More than 40 per cent of the shares of Bahrain’s stock exchange is also owned by investors from the Gulf. Geographically speaking, the bulk of foreign assets in Bahraini banks come from Western Europe and the GCC. The liabilities are also mainly to Western Europe and the Gulf countries.

Bahrain’s competitive advantages on the regional and global scale are its open economy, its liberal economic policy and promotion of private enterprise. The country allows companies to be set up with 100 per cent foreign capital; it has no income tax, no profit tax (only oil and gas companies are taxed at the rate of 46 %), and no VAT; it has no restrictions on the export of capital, income and royalties and no customs duties on the import of machines, equipment and raw materials.

Simplified visa requirements for foreigners, the existence of industrial and commercial zones with low rent, cheap fuel, water and electricity contribute to a favourable business climate in the country [5].

In 2016, the Heritage Foundation in 2016 put Bahrain 18th in the world in terms of openness (Table 1).

Table 1. Economic Freedom Rating of Countries in 2016

| Rating | Country | Points | Change on previous year |

|---|---|---|---|

| 1 | Hong Kong | 88,6 | -1,0 |

| 2 | Singapore | 87,8 | -1,6 |

| 3 | New Zealand | 81,6 | -0,5 |

| 18 | Bahrain | 74,3 | +0,9 |

| 153 | Russia | 50,6 | -1,5 |

Bahrain is the highest ranked of the 17 Middle East countries in terms of economic freedom (Table 2).

Table 2.Regional Economic Freedom Ratings in 2016

| Rating | Country | Points | ∆ compared with 2015 |

|---|---|---|---|

| 1 | Bahrain | 74,3 | 0,9 |

| 2 | UAE | 72,6 | 0,2 |

| 3 | Qatar | 70,7 | -0,1 |

| 3 | Israel | 70,7 | 0,2 |

| 5 | Jordan | 68,3 | -1,0 |

Source: Regional Ranking. www.heritage.org/index/сountry/Bahrain

In 2015, Bahrain ranked 50th out of 175 countries in the International Corruption Perception Index. For comparison, Russia was in 119th place. According to the Doing Business 2016 Report, Bahrain ranks 65th among the world’s 183 countries and second in the Arab region.

Bahrain is a global leader in Islamic finance. For the second year in a row, Bahrain has been recognized as the leading Islamic financial centre in the Gulf states, and the second among 92 countries after Malaysia.

Bahrain and Russia: Areas of Cooperation

Institutional investment is a relatively new, but rapidly developing area.

The main areas of bilateral cooperation discussed during the meetings were energy, oil and gas, agriculture, finance, civil aeronautics and the medical industry. Bahrain is interested in Russia’s production capacity in the military sphere. It has to be noted that the potential for bilateral trade and economic relations between Russia and Bahrain has not yet been tapped, despite the positive trend. In 2011, Russia ranked 43rd among exporters and 18th among importers.

In 2015, trade between the two countries totalled $12.2 million. The main items of Russian export ($4.3 million) are ferrous metals, paper and cardboard, lasers, alcoholic and non-alcoholic beverages, and chemicals. Imports from Bahrain doubled exports and stood at $7.9 million. The key items were aluminium and articles made from aluminium, distillates and other petroleum products, furniture, timber and wood articles, and perfumes.

To promote investment cooperation, the countries signed an agreement on the promotion and protection of investments in April 2014. At the same time, the Bahrain investment fund Mumtalakat signed an agreement with the Russian Direct Investment Fund (RDIF). In December 2014, they reached an agreement on the participation of Mumtalakat in the co-financing of practically all RDIF projects in the amount of 5 %.

Russian banks and companies can see Bahrain as a venue for listing their securities. Bahrain is interested in increasing the liquidity and capitalization of its stock market and diversifying investment opportunities. Prior to the IPO of Zain telecommunications company in the autumn of 2014, the last public offerings in Bahrain were held in 2010. The political support for financial interaction with Russia and the readiness of regulatory agencies to create conditions for placing Russian securities on the markets also attests to this opportunity.

Bahrain also has the potential to be a suitable site through which Russian business can access the financial markets of the region. Partial isolation of major Russian banks from the European and American financial markets, the growing pressure of sanctions on trade cooperation, the need for alternative sources of stable financing of infrastructure and sectoral projects – all this prompted the discussion of regulating the activities of Islamic financial institutions in Russia. They can break into the market by entering the capital of local or regional banks and creating joint funds.

Vladimir Puitin and Hamad bin Isa Al Khalifa,

Sochi, 2016

Innovation and technological cooperation is an important area in which Russian companies can offer competitive services and products, not only to Bahrain, but also to other countries in the region. In 2014, the Russian company Macroscop entered the Bahraini market with its software for city security systems.

In oil and gas, the priority is cooperation on the use of advanced Russian technologies to enhance the yield of oil wells, prospecting work in transit zones and at great depth, supplies of liquefied gas, and the construction and operation of gas pipelines. Joint projects in the energy sector are an effective way of countering mitigating competition for Russian companies in the Gulf markets.

In 2014, Bahrain created its National Space Science Agency. Russia can offer Bahrain cooperation in the field of space research, the development of cutting-edge space technology, space services in remote earth sensing, space communications, navigation, space education, flights to the International Space Station, etc. Bahrain can be seen as a centre/hub for promoting space services and products to the Gulf countries and Africa.

One way to increase trade is to involve Russian companies in Bahraini infrastructure projects in energy, and the construction of desalinization and purification plants, as well as tourist and residential complexes. Another necessary and promising area can be the creation of a joint engineering service company to service projects in Bahrain and neighbouring countries. The training of technical personnel can be an important component there.

It has to be noted that the potential for bilateral trade and economic relations between Russia and Bahrain has not yet been tapped, despite the positive trend.

A direct air link was opened between Bahrain and Russia in October 2014. Given the right approach – investment and promotion of Bahrain in the Russian Federation and vice versa – a substantial increase of two-way tourist flow can be achieved.

The prospects for Russian companies on the GCC market can be described as fairly good. With the rouble exchange rate falling, Russian products and services are competitive price-wise. Bahrain’s commitment to diversifying its foreign economic partners offers additional opportunities for Russian suppliers on its market.

During the King of Bahrain’s visit to Russia in September 2016, agreements were signed on trade in liquefied gas and joint investments between Bahrain’s Nogaholding and Gazprom; geophysical prospecting between Nogaholding and Rosgeologia; military cooperation; and the creation of an intergovernmental commission for trade and scientific-technical cooperation.

Bahrain is already running a pilot project of a Russian company, and a decision will be made based on the results of the project on whether or not to carry out full-scale work on the processing of geophysical data.

One way to increase trade is to involve Russian companies in Bahraini infrastructure projects in energy, and the construction of desalinization and purification plants, as well as tourist and residential complexes.

We should keep in mind that, in spite of diminished oil revenues, the Bahrain economy is trending upwards, as witnessed by its investment policy: a $1.1-billion project to modernize and expand the country’s international airport has been launched; a tender has been announced for a $5-billion project to expand the production capacity of the Bapco refinery from 260,000 to 350,000 barrels per day; construction of a new $300-million pipeline to carry 400,000 barrels of crude oil from Saudi Arabia to Bahrain per day is to be completed by the end of 2017; and a $600-million LNG terminal is to be put into operation in 2018.

The growth of the building sector and real estate prices in Bahrain, unlike other countries in the region, also attest to the country’s economic stability and bodes well for Russian investors wishing to enter the Bahraini market.

Bahrain, which has a developed infrastructure, the most liberal legislation in the region, a highly skilled workforce, observes international standards in business and has a friendly cosmopolitan atmosphere, is a good place to start in the Gulf countries. Considering the commitment of the island’s leadership to developing cooperation with Russia, Russian business can take advantage of the current conditions to penetrate the regional market.

1. Annual Review 2015. Aluminium of Bahrain. 68 pp.

2. Monthly Trading Bulletin // Bahrain Bourse. June 2016

3. Digby Lidsone. Bahrain Exploits Grand Prix Pulling Power // Financial Times, April 20, 2009.

4. The Kingdom of Bahrain: A Small Country with Big Opportunities / Ed. by I. A. Aydrus (Manama: International Press, 2012).

5. The Kingdom of Bahrain: A Small Country with Big Opportunities / Ed. by I. A. Aydrus (Manama: International Press, 2012).

(no votes) |

(0 votes) |