The signing in December 2023 of the U.S. President’s decree imposing secondary sanctions on foreign financial institutions found to be supporting Russia’s military-industrial base made international settlements between Russian companies and their counterparties in “friendly” nations much more difficult. The precedent of discrimination against Russian clients was set as early as February 2024 by a number of leading banks in Turkey, the UAE, India, China, Kazakhstan and Uzbekistan. Citing security concerns, they took to declining requests to open accounts for Russian legal entities, suspending transfers, increasing payment processing times, rejecting or returning funds and screening Russian partners for cooperation with the Russian defense industry and inclusion in sanctions lists.

The obvious reason for another demarche of the “allies” was the June expansion by the Biden administration of the list of sanctioned individuals and legal entities both in Russia and abroad. The targets of secondary sanctions now include financial institutions in Asia, the Middle East, Europe, Africa, Central America and the Caribbean, whose activities are somehow connected with supporting the Russian military-industrial sector.

It can be argued that the main reason for today’s geopolitical tensions in the world is the persistent desire of the Western bloc led by the United States to maintain its dominance in the financial and innovative development of the global economy. By extending secondary sanctions to foreign financial institutions, the White House administration is trying to derail Russia’s efforts to build an alternative financial infrastructure together with “friendly” nations, which would be independent of Western institutions. This move seems more than justified given the growing weight of the Global Majority countries in the real sector of the world economy. Meanwhile, the coalition of developed nations seeks to keep emerging economies in a dependent and subordinate position as suppliers of raw materials and manufactured goods, while preventing their participation in the management of international financial flows.

It is obvious that within the established global electronic payment infrastructure, which is directly linked to the banking system, evading sanctions will become increasingly difficult. In this regard, participants in international transactions are actively exploring the potential of using cryptocurrencies to make secure payments.

Overall, it should be recognized that the primary function of cryptocurrency is to serve as a speculative financial asset and a method of conducting financial transactions outside of government control. Therefore, as long as there are sovereign states, it is unlikely that non-sovereign digital currencies will play any significant role in the monetary system, and even less likely that they will be widely used in international settlements, thus limiting the role of the dollar.

To improve the efficiency of the global financial system, abandoning the use of national currencies in international settlements in favor of common monetary units as objects of supranational foreign exchange regulation has long been overdue.

Despite some degree of integration within existing regional currency unions and occasional initiatives to create new groupings, there is no clear progress in this area today. This stagnation is caused not so much by economic reasons as by political factors.

The BRICS grouping is possibly the only association capable of seriously challenging the unipolar financial system. Overcoming dependence on the U.S. dollar and Western financial institutions seems contingent on creating a fully self-sufficient BRICS interregional financial architecture. It should include banks, stock exchanges, rating agencies, benchmarks for commodity prices and interest rates, auditing, legal and information standards, essentially mirroring all the elements that currently underpin the dollar’s hegemony. The key difference is that this entire architecture would service a common monetary unit that would simultaneously belong to all BRICS members and none individually, i.e. without granting unilateral advantages and privileges, as is the case with the U.S. dollar.

A BRICS interregional currency is a prerequisite for financial multipolarity. However, the successful launch of this megaproject requires carefully designed principles of issuance, supply, distribution and circulation of common liquidity. This must incorporate the latest advances in financial technology and macroprudential regulation, while also considering the civilizational and structural differences among BRICS economies. Achieving this monumental task will clearly require much more resources than those currently available. Yet delaying serious and consistent efforts in this area may push future unproductive costs to an unaffordable level.

The signing in December 2023 of the U.S. President’s decree imposing secondary sanctions on foreign financial institutions found to be supporting Russia’s military-industrial base made international settlements between Russian companies and their counterparties in “friendly” nations much more difficult. The precedent of discrimination against Russian clients was set as early as February 2024 by a number of leading banks in Turkey, the UAE, India, China, Kazakhstan and Uzbekistan. Citing security concerns, they took to declining requests to open accounts for Russian legal entities, suspending transfers, increasing payment processing times, rejecting or returning funds and screening Russian partners for cooperation with the Russian defense industry and inclusion in sanctions lists. In July, Bloomberg reported new problems faced by several Russian exporters when making payments in yuan. Along with that, there were reports about the suspension of transactions made by Russian residents with cards issued by some Russian banks that use the Chinese payment system UnionPay.

The obvious reason for another demarche of the “allies” was the June expansion by the Biden administration of the list of sanctioned individuals and legal entities both in Russia and abroad. The targets of secondary sanctions now include financial institutions in Asia, the Middle East, Europe, Africa, Central America and the Caribbean, whose activities are somehow connected with supporting the Russian military-industrial sector. The new sanctions list also features branches of leading Russian banks located in Beijing, Mumbai, New Delhi and Hong Kong. It seems that banking hiccups for Russian counterparties are becoming an unhealthy practice of “friendly” nations as a protective measure against secondary sanctions. Meanwhile, the blocking of Russia’s international settlements may have ambiguous grounds. A more comprehensive analysis of the motives behind the tightening of sanctions is required to understand them and identify potential solutions.

Who is to blame?

It can be argued that the main reason for today’s geopolitical tensions in the world is the persistent desire of the Western bloc led by the United States to maintain its dominance in the financial and innovative development of the global economy. By extending secondary sanctions to foreign financial institutions, the White House administration is trying to derail Russia’s efforts to build an alternative financial infrastructure together with “friendly” nations, which would be independent of Western institutions. This move seems more than justified given the growing weight of the Global Majority countries in the real sector of the world economy. Meanwhile, the coalition of developed nations seeks to keep emerging economies in a dependent and subordinate position as suppliers of raw materials and manufactured goods, while preventing their participation in the management of international financial flows. This clash of interests is fundamentally impossible to resolve due to several specific features inherent in the functioning of the system of international relations at the present stage.

First, the loss of functionality of and trust in global institutions (WTO, IMF, UN Security Council, UN International Court of Justice, International Criminal Court) as a mechanism of checks and balances for resolving conflict situations on a multilateral basis. The inefficiency of global regulators is evident in the rise of trade, currency and sanctions wars, increased military spending and more direct armed conflicts, the escalation of pandemic and cybersecurity threats and the aggravation of climate, energy and food risks.

Second, the absence of a clear center of gravity consolidating ideologically close developing nations into a single geopolitical bloc. The countries of the collective West recognize the U.S. as an undisputed leader, whose actions are unconditionally supported by them, even if they are at odds with the norms of international law and sustainable development goals. This position stems from a lingering sense of civilizational superiority of the white race, which for centuries served as a justification for the global colonial system. But even in modern times, the neocolonial perspective on international relations persists in the Western worldview, as reflected in the politically correct division of countries into developed and developing ones. In contrast, the Global Majority countries strive for a more equal, fair, multipolar world not dominated by any single pole of power. This may also explain the absence of a clear leader among the developing countries that could promote a coordinated political agenda at the global level. At the same time, China’s aspirations for world leadership in the economic, scientific and technological realms are evident.

Third, the lack of effective leverage over the rapacious financial appetites of the hegemon in the world economy due to the U.S. control over the key institutions of the global financial architecture. The U.S. holds a blocking stake in international monetary and financial organizations—the IMF and the World Bank Group—which set the rules of the game in the global financial system. All commodity prices, which de facto serve as tangible security for the dollar emission (as gold once did), are denominated in the U.S. dollar. Stock pricing in strategic commodity markets is subject to occasional manipulations, which generate surplus profits for U.S. investment funds and losses for developing economies heavily dependent on exports of raw materials. The Big Three U.S. rating agencies still control 95% of the global credit rating market. This has a direct impact on the cost of raising financial resources in the international capital market. The lower the cost of borrowed resources, the stronger the financial advantage and capacity for acquisitions. Institutional monopolization of global financial intermediation functions puts U.S. business in a privileged position in the system of global corporate control. For example, 14 out of the world’s 20 largest asset management companies come from the U.S. These firms are majority shareholders of the most well-capitalized corporations such as Microsoft, Apple, Alphabet, Amazon, Nvidia—the world leaders in creating global digital and information technologies. Another indication of this financial dominance is that in the fiscal year 2023, U.S. corporations accounted for 38% of the total profits generated by the world’s 500 largest companies.

Fourth, the deep integration of the international settlement system into the structures of the global banking system. Despite continuous financial innovations, international settlements are still carried out through a network of interbank correspondent accounts. Tracking electronic payments through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) makes it extremely vulnerable to outside interference. The dominance of the dollar and U.S. banks across all segments of the global financial market in the absence of a global alternative to SWIFT gives the U.S. an unprecedented level of financial power to disconnect individual banks from the global financial system, freeze foreign exchange reserves and deny borrowers access to international debt and equity financing.

Fifth, the digitalization of global finance. The rise of financial technology (Fintech) is increasing tensions in international settlements rather than easing them. The digitalization of financial services makes it possible to scale up existing financial intermediation processes while simultaneously exacerbating price volatility and weakening centralized control over the actions of market players due to the widespread use of distributed ledger technology (whose origins, again, trace back to American developers). To streamline financial transactions, major U.S. banks are now actively using cloud services from vendors such as Microsoft Azure, Amazon Web Services and Google Cloud Platform. Meanwhile, the integration of top U.S. financial institutions with tech giants may give rise to a new generation of global financiers, even more insatiable and uncompromising in their choice of methods and means for maximizing profits.

What to do?

It is obvious that within the established global electronic payment infrastructure, which is directly linked to the banking system, evading sanctions will become increasingly difficult. In this regard, participants in international transactions are actively exploring the potential of using cryptocurrencies to make secure payments. Cryptocurrencies undoubtedly offer an interesting avenue for developing a decentralized system of international settlements, but only as a transaction-recording technology or a digital financial asset. At the same time, cryptocurrencies lack such basic functions of money as a measure and store of value. In the former case—because their value is measured in fiat currencies (mainly the U.S. dollar), and in the latter case—because of their extreme volatility. In addition to the risk of rapid depreciation, cryptocurrencies are not immune to default and liquidity risks, as crypto services and exchanges may also be subject to sanctions. The same risks apply to stablecoins.

Overall, it should be recognized that the primary function of cryptocurrency is to serve as a speculative financial asset and a method of conducting financial transactions outside of government control. Therefore, as long as there are sovereign states, it is unlikely that non-sovereign digital currencies will play any significant role in the monetary system, and even less likely that they will be widely used in international settlements, thus limiting the role of the dollar. Neither the U.S. government nor the Federal Reserve sees the advantages of cryptocurrencies over fiat money. So cryptocurrencies are unlikely to replace the dollar as a reserve asset either.

On the other hand, cryptocurrency poses a unique challenge to the current financial system, where regulators have lost control over money circulation. Global income is concentrated in wealthy countries—the issuers of reserve currencies that have exhausted the possibilities for productive investment of the savings of the rest of the world. As a result, excess capital is mainly used for consumption and speculation rather than investment, exacerbating the global debt problem and social polarization between the core and periphery of the world economy. To regain control over money circulation, central banks are actively exploring distributed ledger technology to issue their own digital currencies. However, this prospect is also highly uncertain due to the still poorly understood risks associated with cyber-financial systems, which operate on the root domain name servers of international entities such as ICANN, IANA and VeriSign with strong American dominance. In light of this, the use of digital currencies in international settlements requires the development of proprietary software and server infrastructure to secure digital platforms against the risks of transaction tracking by “unfriendly” states. However, this effort simultaneously introduces intractable “side effects” related to cybersecurity, compatibility of technologies, standards and protocols for digital currency circulation, as well as legal regulation of multiplatform systems at the international level.

BRICS development horizons

A comprehensive analysis of the causes and consequences of the sanctions on Russia spawns more questions than answers. Nevertheless, the problem of Russia’s international financial isolation is only a special case in the generally dysfunctional global financial system. The fundamental flaw of today’s currency standard lies in the contradiction between the globalization of the market and the national form of its regulation. This discrepancy is most evident in the use of the U.S. national currency for international transactions. To gain access to dollar liquidity, all other countries must continuously adapt their macroeconomic and monetary policies, as well as the production and export structures to the interests of the country that issues the key reserve and investment asset. In serving as a link between the U.S. monetary system and the national monetary systems of other countries, the dollar acts as a channel through which the problems of U.S. domestic socio-economic development are transmitted to the global level, spurring imbalances, periodic bursting of financial bubbles and debt crises.

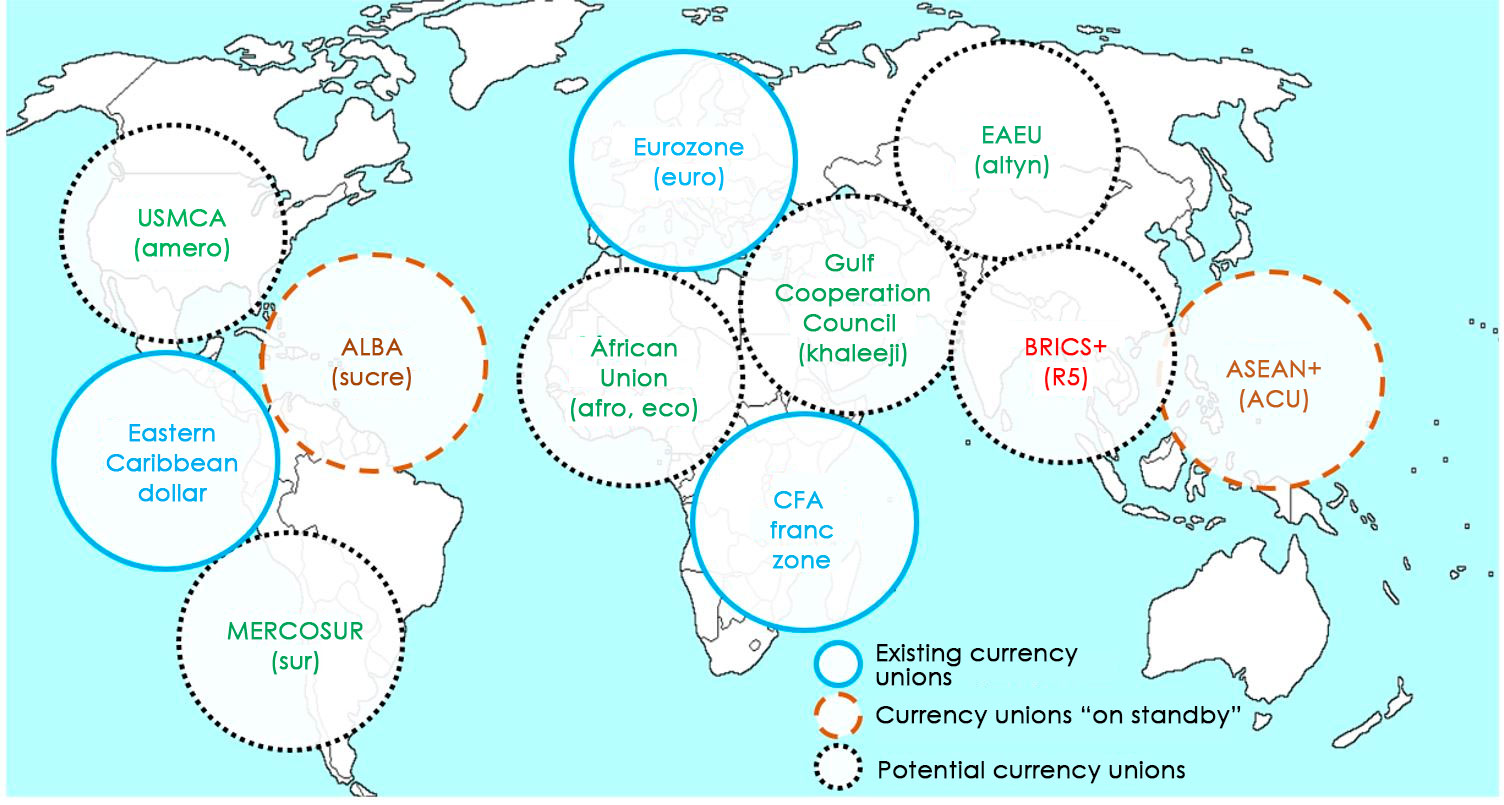

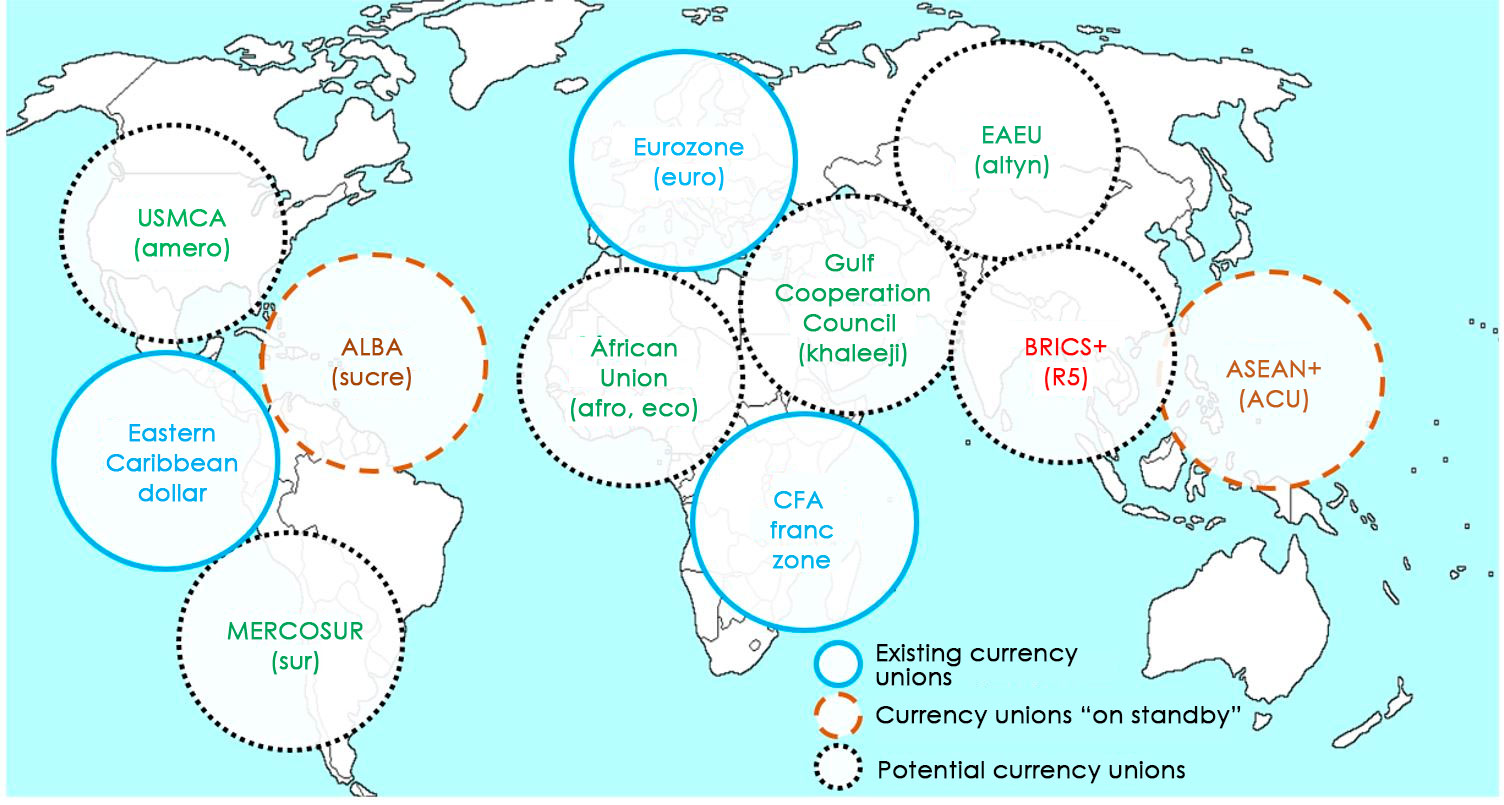

To resolve this contradiction and improve the efficiency of the global financial system, abandoning the use of national currencies in international settlements in favor of common monetary units as objects of supranational foreign exchange regulation has long been overdue. As geopolitical tensions continue to rise and regionalization processes accelerate, this development seems quite reasonable. Especially because the public demand for common currencies has existed for decades. This is evidenced by dozens of currency unions, both existing and potential, in the world economy (see the figure below).

Figure. Existing and potential currency unions in the world economy

Despite some degree of integration within existing regional currency unions and occasional initiatives to create new groupings, there is no clear progress in this area today. This stagnation is caused not so much by economic reasons as by political factors.

It is no secret that the key to the historical ascent of the U.S. to the pinnacle of the world economy was the political unification of the separate North American states into a single federal state. So the political union emerged in the U.S. much earlier than the monetary union, whose origin is directly linked to the establishment of the Federal Reserve System in 1913. The ability to form a unified state demonstrates a deep understanding among Americans of the economic benefits of running a single economy versus a politically fragmented one.

The situation looks different in other regions. For example, the euro, the single European currency, has failed to create a meaningful counterweight to the U.S. dollar in the global financial arena. The reason for this “fiasco” lies not so much in the difference in economic potentials as in Europe’s political disunity. The euro is the currency of 20 sovereign states that have relinquished their national currencies as symbols of political, economic and financial sovereignty. Meanwhile, many of the 20 member states of the EU’s Economic and Monetary Union pursue their own political, economic and financial ambitions, viewing fellow members as competitors. Hence the serious imbalances in the development of individual eurozone members such as Germany and Greece. To address these gaps, Europe lacks the equivalent of the unified fiscal, banking and exchange policies that are at play in the U.S. As a result, eurozone countries are chronically dependent on the capital markets of London and New York, while the European Central Bank, as the issuer of the single European currency, is reliant on the Federal Reserve’s dollar swap lines. Given these challenges, the euro model can hardly serve as a prototype for creating common monetary units in regional currency unions.

Thus, none of the existing projects of supranational monetary cooperation represents a serious alternative to the dollar-centric financial system. It is important to note that the U.S. spared no investment to make this system convenient for all international participants. That is why the U.S. played a major role in establishing the Bretton Woods institutions, where it remains the largest shareholder. In addition, despite growing opportunism within the U.S. establishment, Washington continues to provide core funding for the most important UN institutions, as well as for high-profile research centers, expert commissions and professional associations, regulatory and supervisory bodies servicing international markets for goods and services. Maintaining this global infrastructure requires enormous and sustained financial injections, involving all other countries besides the U.S., even those under its sanctions. Collectively, these investments ensure the inviolability of the dollar standard.

It should be noted that there are no comparable “investments” in any of the existing currency unions, let alone potential ones, including the BRICS grouping, which aspires to a parity role in the global financial system. The existing BRICS financial initiatives, such as the New Development Bank, the Contingent Reserve Arrangement (CRA), the use of national currencies and payment systems for international settlements are too dependent on the dollar and the U.S.-centric financial architecture, making them largely ineffective. Other obstacles to creating a full-fledged BRICS financial system include a lack of trust among BRICS members and an unfavorable balance of payments.

Despite the problems cited above, the BRICS grouping is possibly the only association capable of seriously challenging the unipolar financial system. Overcoming dependence on the U.S. dollar and Western financial institutions seems contingent on creating a fully self-sufficient BRICS interregional financial architecture. It should include banks, stock exchanges, rating agencies, benchmarks for commodity prices and interest rates, auditing, legal and information standards, essentially mirroring all the elements that currently underpin the dollar’s hegemony. The key difference is that this entire architecture would service a common monetary unit that would simultaneously belong to all BRICS members and none individually, i.e. without granting unilateral advantages and privileges, as is the case with the U.S. dollar.

A BRICS interregional currency is a prerequisite for financial multipolarity. However, the successful launch of this megaproject requires carefully designed principles of issuance, supply, distribution and circulation of common liquidity. This must incorporate the latest advances in financial technology and macroprudential regulation, while also considering the civilizational and structural differences among BRICS economies. Achieving this monumental task will clearly require much more resources than those currently available. Yet delaying serious and consistent efforts in this area may push future unproductive costs to an unaffordable level.