Almost four years ago, after years of difficult negotiations, the Iran nuclear deal, also known as the Joint Comprehensive Plan of Action (JCPOA), was signed. Many viewed it as a diplomatic triumph, which would open the door for Iran’s reintegration into the global economy and restoration of its ties with the West. However, it was too soon to make such conclusions.

Three years after the nuclear deal was struck, two years after most Western economic sanctions had been lifted and before Donald Trump’s May 2018 decision to withdraw from the deal, Iran still lagged behind on its planned economic revitalization and renovation of its energy sector. In fact, Iran failed to significantly increase its oil production, to upgrade its oil and gas infrastructure and to revitalize its economy.

A whole set of factors contributed to this, including continued limitations placed on Iran by the U.S, time-frame restrictions for restoring its energy sector and domestic economic issues, low oil prices, and a change in the U.S. administration. All of these factors ultimately contributed to Iran’s inability to restore its energy sector and to revive its economy.

Ultimately, Donald Trump’s decision to withdraw from the Iran nuclear deal in May 2018 and to reinstate all U.S. sanctions on Iran in November 2018 ruined Tehran’s plans to continue slowly but gradually increasing its oil production and exports, to restore its crippled economy and to effectively re-engage with the West and the global economy.

2011–2012 Flashback

The current situation in a way reminds us of events of 2011–2012 when the Iranian economy and oil industry were hit by economic and financial sanctions in an attempt to curb the Iranian nuclear program. Those sanctions in addition to the U.S./EU oil embargo introduced in June 2012 damaged the Iranian oil industry and economy in general. This is why it is useful to look back at the effects of the 2011–2012 sanctions on Iran’s oil production and exports.

Starting from 2012, Iranian oil industry’s production dropped by 17 percent (from 3.74 million barrels a day (mbd) in 2012 to 3.12 mbd in 2014), while its oil exports decreased by about 60 percent from a peak of 2.5 mbd before 2012 to just over one million barrels a day from 2013–2015.

The oil embargo consequently decreased Iran’s oil exports to its major market – Asia and the Pacific. By 2015 Tehran’s oil exports to this region fell by 43 percent from 1.8 mbd to 0.9 mbd. This decrease in exports to a traditionally strong market had a significant impact on Tehran’s income from oil trade.

Although Europe has never been a major market for Iranian oil, it usually accounted for 30-35 percent of Iranian oil exports. After the 2011 sanctions and 2012 oil embargo, exports to Europe consequently decreased by 87 percent, from 0.78 million barrels in 2011 to 0.1 million barrels in 2015. In 2015, Iran exported only 0.1 million barrels of crude oil to Europe which is just 13 percent of 2011 volumes. This led to the loss of Iranian shares of the oil market, which was quickly taken by Libyan and Nigerian oil.

Source: OPEC annual statistical bulletin 2016, 2018, 2019

Post JCPOA Relief

In January 2016, when Iran and the West agreed to lift major parts of the nuclear-related sanctions, including the oil embargo, Iranian oil output started to grow, albeit slowly. Iranian officials repeatedly stated that once the deal was struck and major Western sanctions along with the oil embargo were cancelled, it might increase its oil production by one million barrels a day within six months. However, it never happened.

According to the OPEC Annual Statistical Bulletin 2019, since the majority of sanctions were lifted in January 2016, Iran managed to increase its oil production by 720,000 barrels a day (23 percent increase) in two years, from 3.15 mbd in 2015 to 3.87 mbd in 2017. Thus, Tehran managed to restore and even exceed its pre-sanctions oil production level of 3.7 mbd, although it failed to fulfill its initial plan. With that, Iran still had good chances if not to increase oil production further at least to maintain it at about 3.9 mbd level. Eventually, the U.S. decision to withdraw from the JCPOA heavily affected Iran’s capacity to hit 4 mbd target as its leadership had planned.

The situation with Iranian oil exports was a bit different. Tehran did not manage to raise or even to restore its pre-2012 levels. There are several fundamental reasons for that.

It is important to remember, that after sanctions are lifted, it’s usually extremely hard for an oil exporter to regain its share of the energy market. Once one is out, other players rush in to substitute the missing volumes. Once he is back, no one will willingly allow him to regain his market share. This played an important role in hindering Iran from restoring its pre-2012 sanctions oil export levels, and it will also play a role in the future when and if current U.S. sanctions on Iran are lifted.

Another important factor is Iran’s domestic oil consumption which has been constantly growing. From 2012–2018 it increased by 8 percent to almost 2 mbd, which did not allow Tehran to increase its oil exports. To keep exporting more oil Iran needs to constantly increase its oil production to satisfy both domestic and foreign needs.

And finally, the U.S. is reluctant to restore Iran’s full access to U.S. dollars as it is one of the few effective tools it has for Iran. This is why, even before Donald Trump’s decision to withdraw from the JCPOA, the U.S. did not give Iran full access to external financial markets. This limitation restrains Teheran from accessing the funds necessary to update its aging oil industry infrastructure, which further hinders its ability to increase its oil production at a faster pace.

As we can see, Iran did not manage to significantly increase either oil production or oil exports.

Source: OPEC Annual Statistical Bulletin

After 2015, Tehran restored oil exports to its major market — Asia and the Pacific — to on average of 1.4 mbd which was still 23 percent lower than in 2012. Although Iran was on track to get back to pre-sanction levels of oil exports to Europe in 2017, Donald Trump’s May 2018 decision heavily affected European appetite for Iranian oil and Tehran never succeeded in increasing exports.

In 2018, Iran exported only 0.4 mbd of oil to Europe which is 42 percent less than in 2017. After the U.S. reimposed all sanctions on Iran in November 2018, it seems clear that Europe won’t challenge this decision. For a year already the E.U. has been promising to launch a special purpose vehicle (SPV) to bypass U.S. sanctions and continue trading with Iran, including oil, in order to preserve JCPOA, but as of yet it hasn’t materialized.

2018 Game Changer

Donald Trump’s decision to pull out of JCPOA in May 2018 and his further move to reimpose all sanctions on Iran, including the embargo on Iranian oil exports, proved to be a game changer.

Today, Iran’s oil production has dropped to its lowest level since the 1980’s as U.S. sanctions came into full force in May, the International Energy Agency (IEA) reported. According to OPEC’s June Oil Market Report, Iran’s oil production in 2019 has been consistently falling. It has already decreased by 34 percent to 2.37 mbd in May 2019. As of now, there are no factors in place that could revert this trend in the foreseeable future, which means Tehran’s oil production will likely continue plummeting.

The same is true for oil exports. Six-month long sanction waivers given to eight of Iran’s largest purchasers, including China, India, Japan and South Korea, expired in the beginning of May and it has already had an impact on Iran’s exports. According to industry sources, they have dropped in May to 500,000 barrels per day or lower, which means they have more than halved since the beginning of the year.

Adapting to the New Reality

For the time being it seems that Washington will not stop pressuring Tehran and won’t ease the sanctions which have already hit Iranian oil industry and economy. It’s unlikely that the U.S. will allow anyone, even its allies, to ignore its restrictions.

Politically, it makes today’s situation quite different from the previous round of sanctions in 2011–2012. Hamidreza Azizi, an assistant professor at Shahid Beheshti University, argues (told RIAC) that in political terms, the current situation is far better than compared to the previous period. “There was a unified front of the U.S. and European states against Iran on the nuclear issue and the sanctions were international. This time it’s just about unilateral U.S. sanctions which has been criticized even by the Europeans.”

Viktor Katona, an oil supply specialist at MOL Group, highlights that “the role of European nations was much different back then — the E.U. embraced the 2011–2012 sanctions whilst now it finds itself in an awkward position of tacit disagreement, fear of losing face vis-à-vis the Iranians (who did not breach the JCPOA so far) and wary of U.S.-E.U. confrontation at the same time.”

However, from the economic perspective the current situation is far worse as current sanctions have had a very serious effect on Iran and potentially on European states together with Iran’s Asian trade partners. The goal of the 2012 oil embargo was to curb Iranian oil exports, not to eliminate them altogether, confirms Katona.

Even the fact that Iran has been working on and developing certain mechanisms to bypass the U.S. sanctions, like using intermediaries for selling oil or using third countries, it remains to be seen whether it will work. “Back in 2011–2012 the U.S. was not following this policy of reducing Iran’s oil exports to the zero and the oil prices were at a better level, so it was easier for Iran to cope with the effects of the sanctions,” says Hamidreza Azizi. As a result, today Iran is in a far more difficult economic situation.

Europeans who are not happy with Donald Trump’s decision vis-à-vis Iran are still struggling to launch the Instrument in Support of Trade Exchanges (INSTEX) — a special purpose vehicle which would allow for ongoing trade with Iran. However, the possibility that INSTEX may also be sanctioned by the U.S., as well as individual companies and countries that use it keeps countries willing to continue trading cautiously with Iran. Iran has already established its own Special Trade and Finance Institute as a counterpart to the European INSTEX but now the U.S. may sanction it too.

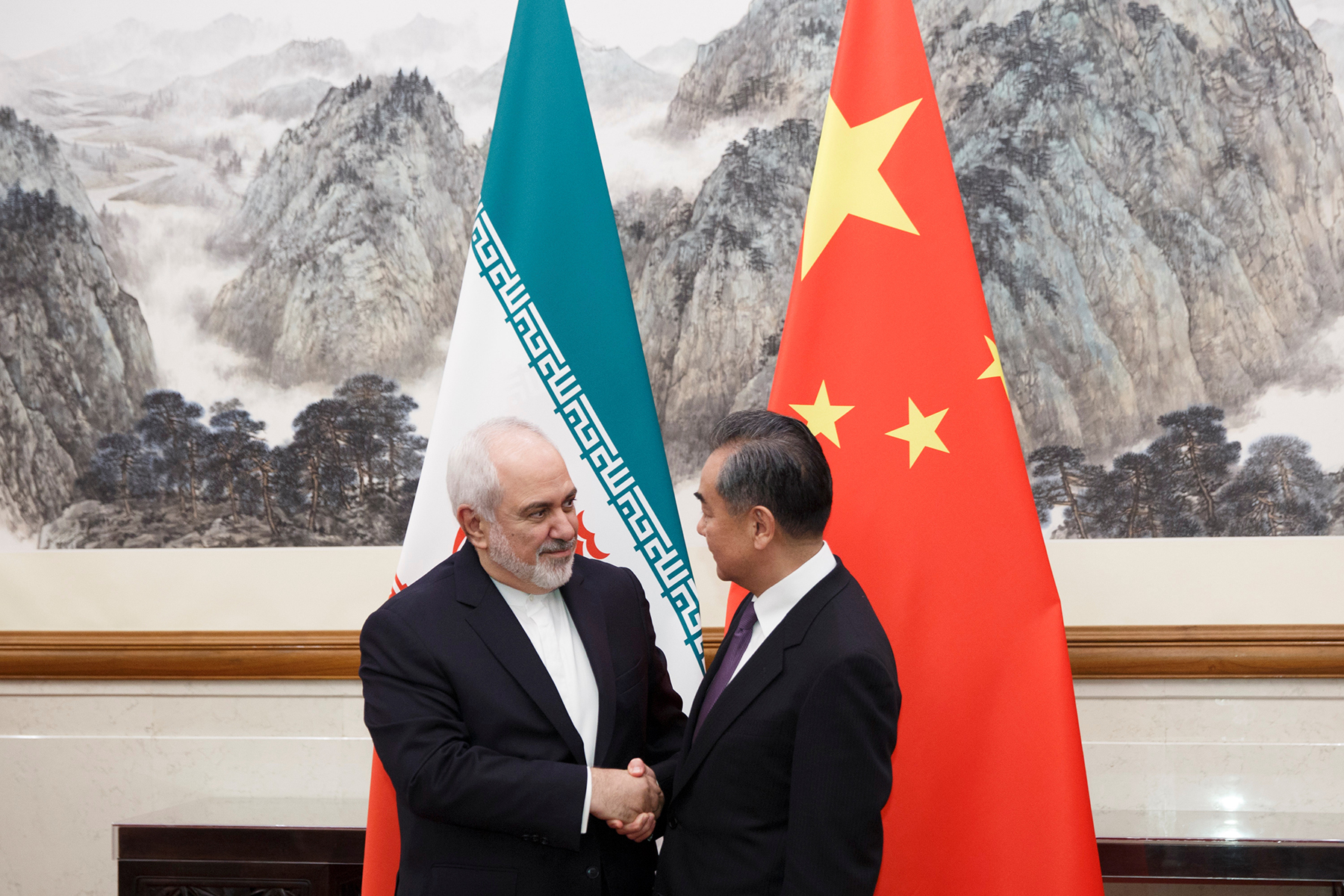

Iran and its biggest oil buyers are looking for alternatives as to how to avoid U.S. sanctions and the oil ban. China, being the biggest consumer of Iranian oil, has insisted that its trade with Iran is perfectly legal and that the U.S. has no right to interfere. Turkey has said it cannot cut ties with its neighbor. Some analysts argue that Iran could also export oil to cover humanitarian needs and might be able to evade the sanctions by exporting oil covertly.

Katona argues that effectively, the current Iran sanctions are unilateral with minimal international backing. China, too, plays a much more active role in countering U.S. pressure, remaining one of the few big markets for Iranian crude after India, South Korea and Japan pledged full adherence to U.S. sanctions.

Tehran is currently in talks with China, Russia, India, Azerbaijan and some others to set up bilateral agreements to establish monetary channels to bypass U.S. sanctions. It remains to be seen whether these attempts will be successful, but by doing this Iran sends a clear signal that it is beginning to prefer Asia to Europe after years of empty promises by the E.U. to protect Iran’s economic interests.

Russian Deputy Foreign Minister Sergei Ryabkov has said that Moscow will help Tehran with its oil sales if the E.U. trade mechanism is not launched. According to a source in the industry, Russia has agreed to a 100,000 bpd crude-for-services swap, which would provide one relatively safe market outlet for Tehran.

In the end, Iran today is under heavier economic pressure than the 2011-2012 period, but at the same time more global and regional actors are against the current U.S. policy towards Iran which gives it more hope for easier ways to bypass sanctions.

Major Challenges for all Parties

Although the current situation somewhat resembles the previous round of anti-Iranian sanctions of 2011–2012, it brings new challenges for everyone.

For Iran, the situation is much worse economically, as the oil prices are lower than they were in 2011–2012 and the country already faced serious economic and financial challenges over the last year. Even if the situation returns to pre-May 2018, it will be difficult for Iran to regain its oil market share and thus recover funds needed to renovate its energy sector and to address economic challenges.

As for the E.U. businesses and states, on the one hand, they chafed under the U.S. extraterritorial sanctions and constant limitations on their policies. They even publicly stated that Europe wants to go their own way. On the other hand, European declarations have not transformed into any meaningful and realistic actions so far and will hardly do that in the near future.

The U.S. sanction policy may sooner or later harm Washington’s long-term interests. In recent years, the U.S. pressures its allies to comply with its sanction policies vis-à-vis Russia, China, Iran, Syria or others which don't enhance the spirit of partnership. Undoubtedly, it won’t change relations between allies overnight or in the short-term. However, if the U.S. continues to exert pressure on its partners over Iran, on top of existing limitations vis-à-vis Russia, China, Syria and others, it risks provoking increasing opposition Moreover, it is unclear what mechanisms Washington is going to use to implement secondary sanctions or what incentives it could offer its partners to drop Iranian oil. Otherwise, the U.S. will need to act against its partners, e.g. Iraq, Turkey, India, etc. which might end up having the opposite effect, prompting them to seek closer ties with other power-centers as a counter-balance to excessive U.S. pressure.

In addition to that, the brinksmanship between Tehran and Washington complicates the entire situation around the two countries. The risk of escalation increased significantly, while simultaneously it affects all spectrum of issues, e.g. global oil prices, the Syrian crisis, Iran-Saudi Arabia and Iran-Israeli confrontation, Russia-U.S. interaction, etc. Given all these potential risks the situation is potentially more explosive than it was back in 2011–2012 and the prospect for Iran to be better off in the end looks dimmer.