The role of nuclear power in the world’s energy mix has long been a topic of intense debate among experts, politicians and business leaders. In the mid-20th century, it was seen as a key solution to meeting global energy needs. However, these expectations were undermined by various factors, including the serious consequences of accidents at nuclear power plants (NPPs). As a result, some developed nations with operational nuclear power plants decided to decommission them, while others, mainly in the developing world, put plans for new nuclear power projects on indefinite hold. Recently, there has been a resurgence of interest in nuclear power, primarily in the Global South.

While the path to financing nuclear power in emerging economies is challenging, the potential benefits promise significant outcomes, including addressing the issue of balancing the energy mix dominated by renewable energy sources. With effective investment mechanisms, nuclear power can play a critical role in meeting growing energy needs and achieving low-carbon development goals.

The global push for nuclear power development offers additional opportunities for Russian company Rosatom to expand its activities in this market. In recent years, Rosatom has become a leader in providing nuclear power technologies to countries of the Global South, steadily expanding its presence in Latin America, the Middle East, Africa and Asia. This strategy is backed by significant state support and makes it possible to find new partners and offer a wide range of nuclear technologies. Rosatom stands out as the only company in the world capable of providing all elements necessary for creating comprehensive national programs for nuclear power development. The state nuclear corporation has repeatedly won bids for reactor construction, positioning itself as a leader in the number of simultaneously executed nuclear reactor construction projects. The company also controls around 20% of the global market for enriched materials for NPP fuel supply. Important forms of promoting Russian nuclear technologies in the energy markets of the Global South include the participation of Russian entities in international organizations such as the IAEA. New platforms for international cooperation include BRICS and BRICS+ formats—in particular, the establishment of a nuclear platform within the group. Russia traditionally holds a strong position in training personnel for the nuclear power sector in the region.

The development and introduction of new types of nuclear reactors, including floating NPPs and small modular reactors (SMRs)—projects that Russia is actively working on—represent promising technological solutions for countries of the Global South. This opens up extra opportunities for Rosatom, as the company can offer cutting-edge equipment to its partners in the foreseeable future and has leading expertise in producing more enriched fuel required for such plants. The shift of leadership in nuclear power development from the Global North to the Global South is a natural process of transformation in global energy markets in the years to come, presenting new opportunities for Russia, which possesses the necessary technologies.

The role of nuclear power in the world’s energy mix has long been a topic of intense debate among experts, politicians and business leaders. In the mid-20th century, it was seen as a key solution to meeting global energy needs. However, these expectations were undermined by various factors, including the serious consequences of accidents at nuclear power plants. As a result, some developed nations with operational nuclear power plants decided to decommission them, while others, mainly in the developing world, put plans for new nuclear power projects on indefinite hold. Recently, there has been a resurgence of interest in nuclear power, primarily in the Global South.

In this article, the conventional concept of the Global South refers to countries in Central and South America, Africa, the Middle East and Asia (including China and India, but excluding the post-Soviet states and OECD nations). From an energy perspective, the countries in this group are primarily interested in ensuring a stable energy supply as well as energy security and, as a consequence, achieving high growth rates in energy and electricity consumption.

An analysis of numerous global and regional energy development forecasts published in 2023–2024 suggests that by the middle of the 21st century, global electricity demand will increase by around 1.8–2.5 times, depending on the development scenario, which considers such factors as growth rates of the global/regional economy and population, development of new technologies, effectiveness of energy efficiency programs and more. All the forecasts agree that countries of the Global South are projected to contribute around 80% of growth in electricity demand, with China alone making up over 45% of the global growth total. India will play a comparatively smaller role in this process, accounting for around 15–18% of the total increase. The vast majority of forecasters point to a global trend toward the development of renewable energy sources (RES), particularly solar and wind power. The growing use of renewables is expected to facilitate the implementation of low-carbon development programs, to which most nations, including those belonging to the Global South, have pledged their commitment.

However, the crucial element of global energy policy today is recognizing nuclear power as one of the key tools in the effort to reduce greenhouse gas emissions and, consequently, achieve climate goals. At COP28, twenty-five nations pledged to triple their nuclear power capacity by 2050. This was the reaction of the world community to the fact that the European Commission’s decision to include nuclear power in the “green taxonomy” had cleared all EU bureaucratic hurdles and had finally come into effect. The declaration to triple nuclear power capacity by 2050 aims to accelerate the decarbonization of the global economy and reduce greenhouse gas emissions to achieve the goals of the Paris Agreement. Some countries of the Global South, such as Ghana, Jamaica, Mongolia, Morocco and the UAE, have also endorsed this declaration.

Specifics of nuclear power generation

Electricity generation at traditional large nuclear power plants (NPPs) often comes with higher costs compared to the most common carbon-free alternatives. It also requires significant upfront capital investment and careful site selection. Building large NPPs is a long and sluggish process that can take up to 20 years to complete. This involves addressing a number of complex issues, which include selecting the reactor type, securing nuclear fuel supply and organizing safe disposal of radioactive waste. For most countries of the Global South, ensuring that the planned NPP capacity is compatible with the parameters of the national energy system is especially important. They must also account for the possibility of temporary shutdowns of NPPs without the risk of disrupting the entire grid. Given the limited scale of the national energy sector, the construction of a large NPP seems inexpedient; therefore, exploring new types of nuclear power facilities, such as small modular reactors (SMRs), appears to be a promising solution. For the Global South, SMRs offer considerable advantages, as they significantly reduce construction and payback periods while increasing investment attractiveness.

Unlike solar and wind power, NPPs can operate continuously, requiring only intraday balancing, which leads to significant cost savings due to reduced requirements for redundancy and storage capacity. Another advantage of nuclear power is the immense energy density of the fuel used. One kilogram of uranium enriched to 4%, when fully burned out, produces as much energy as burning 100 tonnes of high-grade coal or 60 tonnes of oil. In addition, nuclear fuel can be reused after regeneration. Fissile material (uranium-235) can be recycled, unlike ash and slag left from fossil fuel combustion. With the development of fast neutron reactor technology, a transition to a closed fuel cycle is possible, eliminating waste entirely.

Limitations of nuclear power generation

The energy transition and the development of new energy technologies are fundamentally reshaping the energy mix. Increased production of green hydrogen, decarbonization of the transport sector and power supply for electric vehicle batteries and hydrogen fuel cells will require clean energy sources. RES, including solar and wind power, among others, may not fully support this transition due to intermittency issues and low-capacity utilization rates, so nuclear power may become another potential source of clean energy.

Licensing reactor designs can be an important issue. Developing countries generally lack the necessary expertise to do this, so they have to rely on licensing from nations such as the United Kingdom, the United States, France, Russia and China.

One of the key problems faced by countries of the Global South when planning NPP construction is a lack of funding due to limited state budgets or private resources. Under these circumstances, they are compelled to seek external financing, but securing it is quite difficult when sovereign credit ratings are low or there are difficulties in accessing funds from national and international financial institutions.

Development of the nuclear power sector in the Global South

While the path to financing nuclear power in emerging economies is challenging, the potential benefits promise significant outcomes, including addressing the issue of balancing the energy mix dominated by RES. With effective investment mechanisms, nuclear power can play a critical role in meeting growing energy needs and achieving low-carbon development goals.

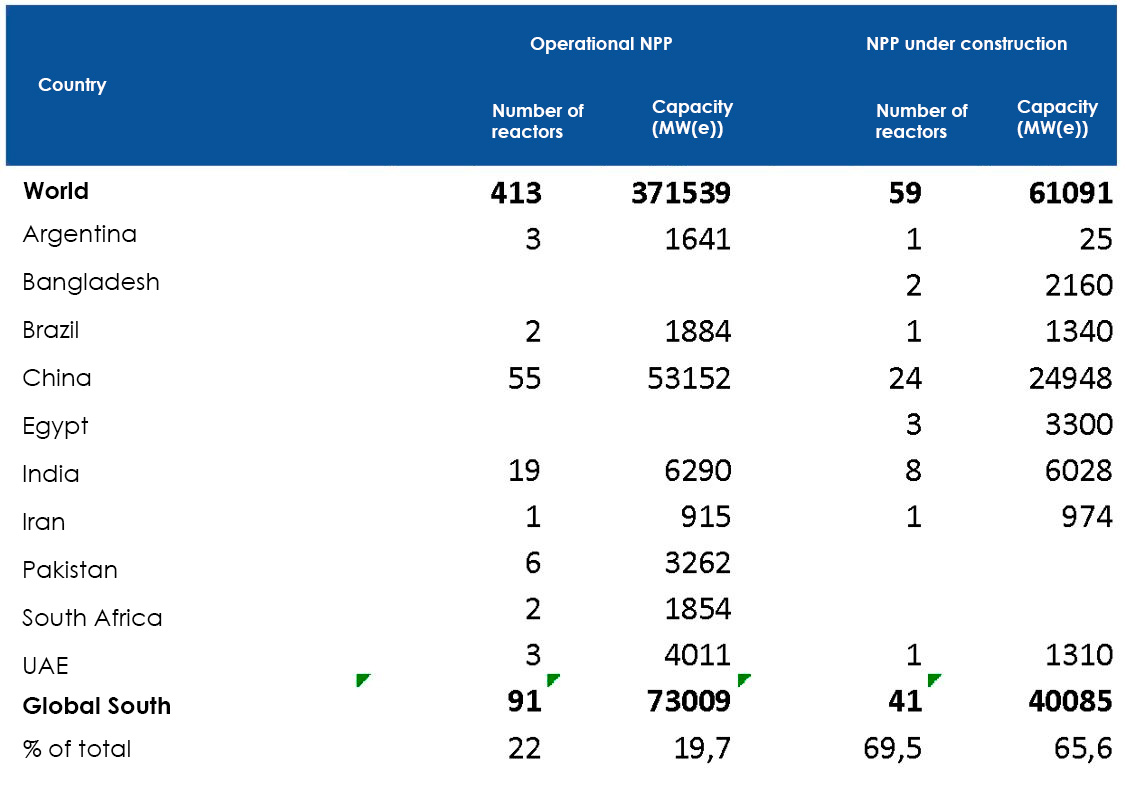

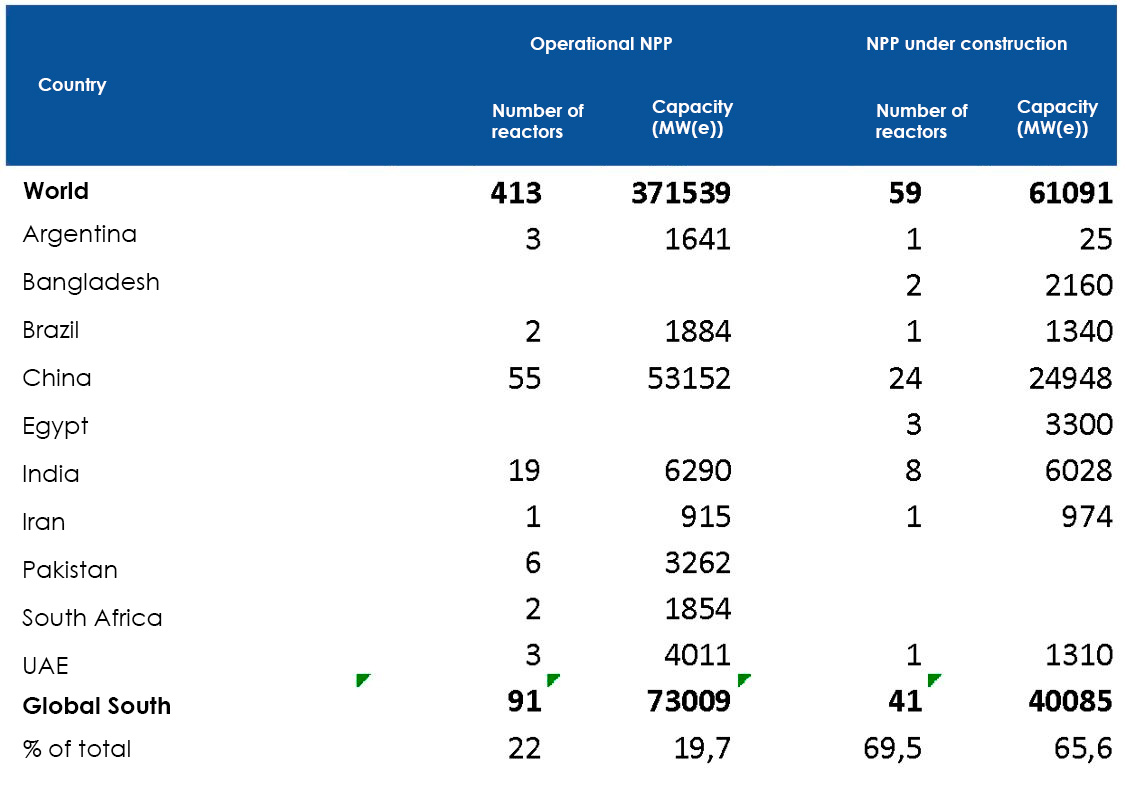

In 2023, there were 413 operational nuclear reactors worldwide, with a total installed capacity of 372 GW. Most of them were concentrated in North America, Europe and developed Asian nations. In the Global South (eight countries), there were 91 reactors in operation (22% of the total number in the world), with an installed capacity of 73 GW. As shown in Table 1, the current contribution of countries in the Global South to the world’s nuclear power generation is relatively modest. But things look very different when we consider the number of reactors under construction, which stands at 41 (or around 70% of all units under construction globally) in countries of the Global South. The number of countries in the region with NPPs is also rising (up to 10). China and India are the region’s leaders in nuclear power and are set to stay at the top through 2050.

Table 1. The number of reactors in countries of the Global South

Source: World Nuclear Performance Report 2024

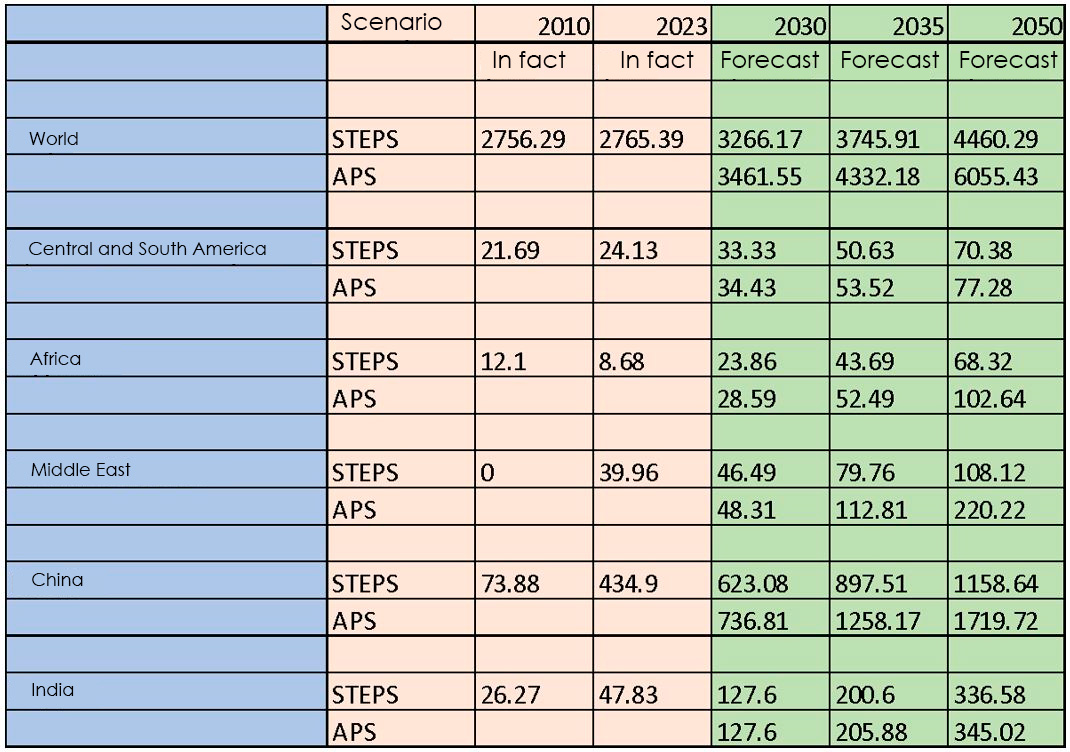

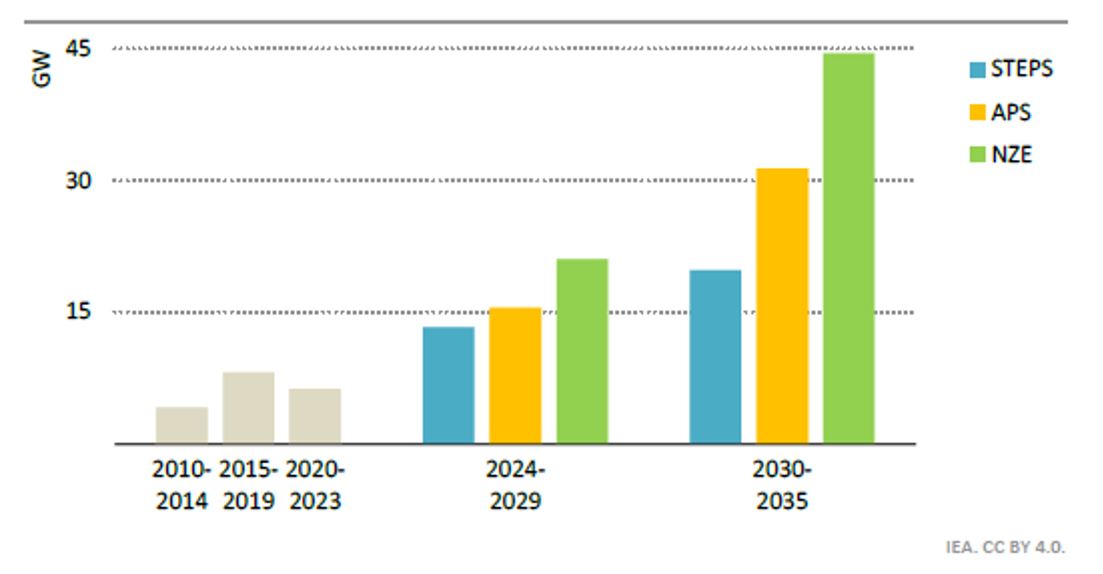

According to most forecasts, the growth of the total installed capacity of NPPs worldwide will reach an average of 800 GW by 2050, which is almost twice the total installed capacity of NPPs in 2023. However, the range of these forecasts varies significantly depending on the scenario under consideration (see Fig. 1). The uncertainty in the estimates of growth prospects for nuclear power arises from many factors. Unlike wind, solar and battery power, which play a key role in achieving ambitious climate goals and have become increasingly affordable over the past decades, the execution of NPP construction projects is frequently plagued by budget overruns and delays. This trend is particularly evident in projections of nuclear power development across the Global South.

Fig. 1. Projected nuclear capacity additions worldwide under various scenarios of the International Energy Agency (IEA) through 2035.

Source: IEA World Energy Outlook 2024

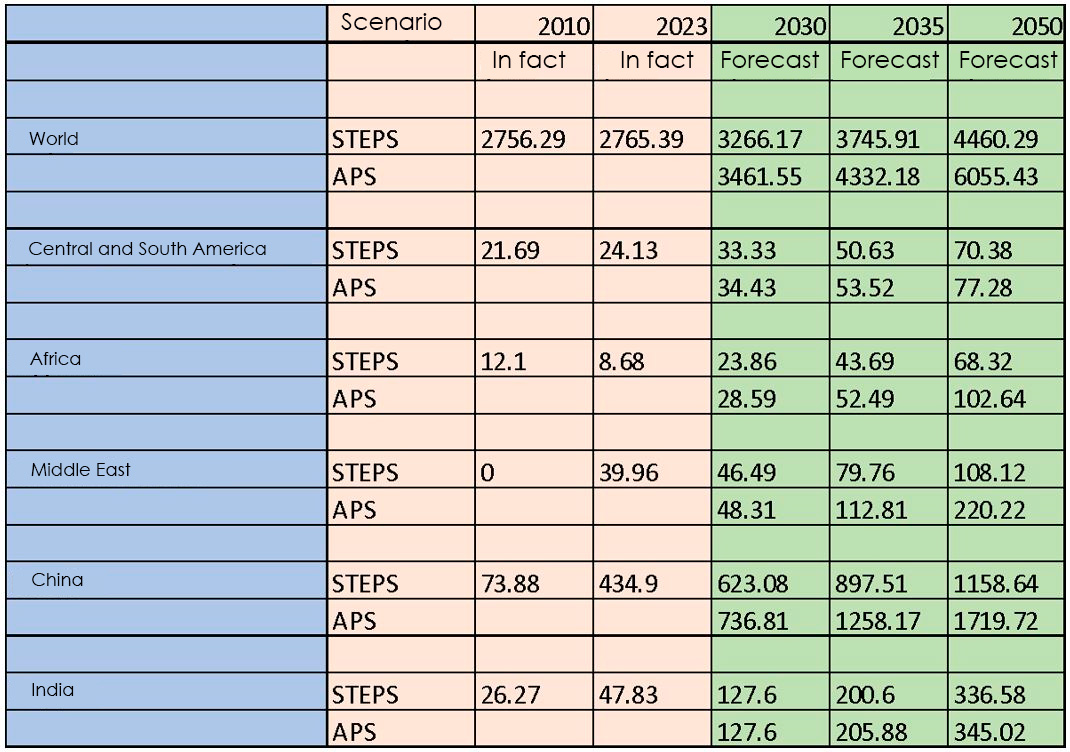

The analysis of the global energy development forecasts suggests that electricity generation at NPPs is expected to rise by 2.4–3.2 times in developing Asian countries, primarily driven by China and India, by 2.5–3.7 times in Africa and by 4.4–7.7 times in the Middle East (Table 2).

Table 2. Scenario projections of nuclear power generation at NPPs in the Global South

Source: IEA World Energy Outlook 2024

Opportunities for Russia

The global push for nuclear power development offers additional opportunities for Russian company Rosatom to expand its activities in this market. In recent years, Rosatom has become a leader in providing nuclear power technologies to countries of the Global South, steadily expanding its presence in Latin America, the Middle East, Africa and Asia. This strategy is backed by significant state support and makes it possible to find new partners and offer a wide range of nuclear technologies. Rosatom stands out as the only company in the world capable of providing all elements necessary for creating comprehensive national programs for nuclear power development. The state nuclear corporation has repeatedly won bids for reactor construction, positioning itself as a leader in the number of simultaneously executed nuclear reactor construction projects. The company also controls around 20% of the global market for enriched materials for NPP fuel supply. Important forms of promoting Russian nuclear technologies in the energy markets of the Global South include the participation of Russian entities in international organizations such as the IAEA. New platforms for international cooperation include BRICS and BRICS+ formats—in particular, the establishment of a nuclear platform within the group. Russia traditionally holds a strong position in training personnel for the nuclear power sector in the region.

The development and introduction of new types of nuclear reactors, including floating NPPs and SMRs—projects that Russia is actively working on—represent promising technological solutions for countries of the Global South. This opens up extra opportunities for Rosatom, as the company can offer cutting-edge equipment to its partners in the foreseeable future and has leading expertise in producing more enriched fuel required for such plants. The shift of leadership in nuclear power development from the Global North to the Global South is a natural process of transformation in global energy markets in the years to come, presenting new opportunities for Russia, which possesses the necessary technologies.