Russian and GCC Perspectives: OPEC, Russia, and falling oil prices

An oil worker walks by an oil pump during

a sandstorm that blew in, in the desert oil fields

of Sakhir, Bahrain

In

Login if you are already registered

(no votes) |

(0 votes) |

Senior researcher at the Centre for Arab and Islamic Studies, the Institute of Oriental Studies, RAS, associate professor at People’s Friendship University of Russia

Director of International and Geo-Political Studies at the Bahrain Center for Strategic, International and Energy Studies (Derasat), affiliated associate professor of economics at George Mason University, USA

Oil prices have declined significantly since the middle of 2014, causing significant concern among major oil exporters, among the Russia and the countries of the Gulf Cooperation Council (GCC; Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE). There have been significant calls for cooperation between the GCC states, other OPEC members, and Russia, with the goal of stabilizing oil prices. Whether or not a substantive agreement emerges remains to be seen.

1. Introduction

Oil prices have declined significantly since the middle of 2014, causing significant concern among major oil exporters, among the Russia and the countries of the Gulf Cooperation Council (GCC; Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE). There have been significant calls for cooperation between the GCC states, other OPEC members, and Russia, with the goal of stabilizing oil prices. Whether or not a substantive agreement emerges remains to be seen. One of the biggest challenges faced by the oil exporters is the issue of building trust in a market that is currently dominated by highly competitive behavior. Moreover, shale oil has recently propelled the US to the top of the oil production pyramid, rendering the forging of a consensus even more difficult than usual.

Russian and GCC commentators are well-acquainted with Western views regarding the collapse in the oil price. However, Russian and GCC commentators are comparatively uninformed about each other’s perspectives regarding this key development due to the nascent nature of relations between the two. This report aims to remedy this communication lacuna by furnishing readers with Russian and GCC perspectives on the issue, delivered by researchers specializing in oil markets.

The views expressed below represent the views of the authors, and they do not necessarily represent the views of the institutions to which they are affiliated, or of their respective governments.

2. A Russian Perspective

Gurgen Gukasian, Russian Academy of Sciences

The Overall Situation in Oil Markets in the Context of Falling Prices

The difficult situation, which has gradually crystallized on the global oil market since 2014, has been exceptional given the severity of the slump in oil prices – with Brent falling from $114/bbl in June 2014 to around $50/bbl in the summer of 2015 and less than $30/bbl in January 2016 (prices stabilized afterwards). The collapse in prices occurred against the background of slowing economic growth in many countries, including major economic players such as China, where energy consumption in 2015 had slowed to 2009 levels. Almost all oil-exporting countries have felt the negative consequences of falling oil prices. With the exception of the United States (a new, significant oil exporter), all other exporters have been forced to curb budgetary spending and support their economies by drawing on currency reserves.

Between February and mid-March 2016, global oil prices—following a protracted devaluation—began a gradual, if at times volatile, recovery, reaching around $40/bbl and even climbing further. At the same time, experts polled by the Russian news agency Ria Novosti held different opinions regarding whether the oil market had already hit its floor.

Russian experts, polled in March 2016, overall agree that, over the course of the year, Brent stock-exchange prices are likely to stay in the range of 35-50 USD/bbl. Only a few months ago, in late 2015, analysts were more optimistic, forecasting an average Brent price for 2015 in the range of 50-55 USD/bbl. According to OPEC data, in January of this year, the daily average oil production of OPEC member states amounted to 32.3 mn bbl/d, which represented an increase of 131,000 bbl/d compared to December. The daily average oil output, reached by individual OPEC countries in that month, was 10.1 mn bbl/d for the Saudi Kingdom, 655,000 bbl/d for Qatar, 1.9 mn bbl/d for Nigeria and 2.3 mn bbl/d for Venezuela. As per International Energy Agency (IEA) information, Russia's daily average production in the same month amounted to 10.9 mn bbl/d. (Russia's January 2016 production of oil with lease condensate amounted to 46 mn tons, which represented a 1.5% year-on-year increase.)

According to the US Energy Information Administration (EIA), the United States' oil production in late December 2015 amounted to some 9.1 mn bbl/d, having peaked at 9.6 mn bbl/d in May of the same year. Between May and December, US daily oil production fell by 500,000 bbl/d. ConocoPhillips forecasts the US' daily oil production to fall by yet another 500,000 bbl/d over the course of 2016. However, the US oil industry has in recent years witnessed a revolution, partly due to the development of technologies enabling shale oil production. As a result, US oil output has almost doubled between 2009 and 2015. According to EIA data, whereas US daily oil production amounted to some 5.0 mn bbl/d in early January 2009, it had grown to 9.6 mn bbl/d in June 2015.

Sophia Kortunova:

When You Just Can’t Say “Yes”. Are Oil Prices

Likely to Go Up?

Actions taken by oil-exporting countries

Experts hold, that the effort by oil-producing countries to agree on concerted action has been one of the reasons for the gradual recovery in oil prices over the course of only one month. In this context, it is important to note that prices rose, approaching 40 USD/bbl, precisely after information about an imminent agreement among oil producers regarding a production freeze at January 2016 levels emerged. At a February 16 meeting in Doha, aimed at supporting global oil prices, Russia, Saudi Arabia, Qatar and Venezuela decided to fix the average 2016 oil output at January levels, but they made it clear that implementation of the freeze was conditional upon other nations agreeing to participate. Readiness to support the measure was expressed by Ecuador, Algeria, Nigeria, Oman, Kuwait and the UAE. While Iran and Iraq professed their intention to contribute to an improvement of the situation on the oil market, they have thus far avoided to consent to a production freeze.

It is possible that a decision regarding the production freeze will be taken at an extended meeting of oil-producing countries, scheduled for April 17, in Doha. According to Russian Energy Minister Alexander Novak, around 15 countries have tentatively confirmed their participation. The minister believes that even more countries could attend. At the same time, not all experts expect miracles from these negotiations, pointing to the prevailing battle for market shares amongst the global oil-producing players.

The Role of Cooperation and Russia's/OPEC's Possibilities of Influencing Oil Markets

Judging from statements made by OPEC and Russian officials, it is clear that an interest in cooperation aimed at supporting the oil price has recently prevailed on both sides, given that the situation on global oil markets has been disadvantageous not only for Russia, but also Saudi Arabia, Venezuela, Algeria and many other exporters. During the 1970s, the Saudi Kingdom – at the time the only swing producer and main seller on the global oil market – was able to significantly influence that market and other OPEC member states, compelling them to adhere to production quotas or to reduce output. (This is because these states understood that the Saudis could always flood the market with additional oil, which would have put pressure on prices up to the point where those countries having violated output quotas would incur losses. The other OPEC members' oil production costs are typically higher than those of Saudi Arabia.)

Viktor Katona:

The level of trust, both within OPEC as well as

among the members of the oil club and non-

member states, is extremely low

After the 1980s, the situation on the global market radically changed, since the Saudi Kingdom – and OPEC more generally – ceased to be the only key players capable of influencing oil prices, given the emergence of new exporters. Russia, for instance, became an important seller, followed by the United States some time later.

In this new constellation, a noticeable impact (on the oil price) can be achieved only if the two main producers – Russia and Saudi Arabia – coordinate their policies, integrating as many other OPEC member states and oil-producing countries (for instance from the post-Soviet space) as possible into the process. Notwithstanding the fact that the world's oil-exporting countries have disagreements amongst each other and face different production and economic problems, their collaboration can produce results, which can to some extent be useful to all.

However, among factors complicating and possibly limiting such collaboration efforts, the most significant is probably the ramping up of US oil production. (Other, more or less understood factors include the possible inclination of participating countries to view the agreement on the production freeze as non-binding, or the refusal of all to agree on the same time periods, etc.)

The US Shale Oil Revolution as a Factor

Notwithstanding all above-discussed possibilities of Russia and OPEC to influence the oil price in ways advantageous to them, analysts point to risk factors possibly undermining the future appreciation of the oil price.

Even though oil prices have possibly already reached, or will soon reach, their floor, it is obvious that a price in the range of 30 USD/bbl does not create economic conditions conducive to drilling operations in all those countries which are not part of OPEC. According to an analyst with Raymond James in Russia, Pavel Moltshanov, oil prices have to be eventually stabilized in order to support a more robust level of investment in the industry. The biggest factor restraining an oil price recovery is the availability of shale oil production in the US, which – according to a number of Russian market analysts, including Aleksey Kalatshev of Finam – has production costs of around 40 USD/bbl.

In the event that Russia and OPEC manage to agree on the freezing or reduction of oil outputs, thereby stimulating prices, US oil companies may start to increase their production at an oil price of around 40-45 USD/bbl. In the process, American shale producers will begin to push those players that lowered their output (Russia and OPEC) out of the market.

It should be noted that, according to EIA data, Russia is possibly home to the world's largest shale oil resources of 75 billion barrels, followed by the US (58 bn bbl), China (32 bn bbl) and Argentina (27 bn bbl). While the balance of power on the oil market will certainly shift in the distant future, it is today fully sufficient for Russia to extract its traditional oil resources.

New Possibilities for Russian-OPEC Collaboration

All these above-discussed problems notwithstanding, the severe fall in oil prices to around 30 USD/bbl has spurred an increased level of activity – intended at the quick development of concerted action – within the energy policy-making circles in Russia and OPEC member states. According to IEA data, oil production in the fourth quarter of 2015 exceeded demand by 1.8 mn bbl/d. Originally, Venezuela proposed the holding of an extraordinary session to OPEC member states.

Moreover, Abdullah al-Badri, OPEC’s Secretary-General, stated at a Chatham House conference in London: «Tough times require tough choices. It is crucial that all major producers sit down and come up with a solution». Al-Badri said the cartel was ready to embrace rivals and work towards a compromise following the 72pc crash in prices since mid-2014. He also pointed out that the industry was witnessing an investment crisis, which could lead to substantial financial losses for oil-producing companies. The Secretary-General warned: «The current glut is setting the stage for a future supply shock, with prices lurching from one extreme to another in a deranged market that is in the interests of nobody but speculators».

Before the meeting of oil-exporting countries in February, Russian Energy Minister Alexander Novak stated: «Regarding the planned production cuts, it is necessary to work through a large number of questions. In order to do that, we have to arrive at a certain agreement. And this will be on the agenda at our upcoming meeting in February.» Commenting on the exchange of opinions preceding the February meeting, the President of the Russian pipeline company Transneft, Nikolay Tokarev, noted: «Saudi Arabia, the main participant in the negotiations, has of course taken the initiative. And it is above all with the Saudis that we have to discuss this question.» In the meantime, it was reported that the Saudi Kingdom had hinted at its readiness to cut production by 5%, in the event that Russia would agree to the same step, though Russia has thus far not seriously considered such a measure.

A. Novak, Russia's Energy Minister, had previously made clear that Russia would not agree to any unilateral reduction in oil output: statements, according to which OPEC had suggested a 5% production cut only by Russia, had circulated in the media, but were never confirmed. Before, Riyadh had contested the possibility of curbing oil production for the sake of supporting global price growth, asserting that the market should handle the evolving situation in a self-regulating way.

Yet, the negotiations produced a different outcome – an agreement between Russia, Saudi Arabia, Qatar and Venezuela to fix average production for 2016 at levels not higher than those of January this year, conditional on the support by the remaining oil-producing countries. 15 states have confirmed their participation in an upcoming meeting of oil-exporting nations in Doha on April 17, at which the issue of a production freeze will be discussed.

Yet, it is much easier to implement such a decision, than to actually reduce output. The measure in question can gradually lower the excess supply of oil, taking into account the requirement of global economic growth, even if that growth is slower than in previous years. Qatar's Energy Ministry will monitor compliance with the agreement. A Qatar government official has pointed out, that the states will consider additional measures over the coming months. And Saudi Arabia's Oil Minister stated after the negotiations, that the freezing of production quotas at January levels is «adequate» and that the Kingdom will be able to cover consumer demand.

Coming to the interests of OPEC member states, it should be noted that Saudi Arabia undoubtedly worried about maintaining its global market share and containing the US' shale oil production expansion, therefore flooding the market with oil and causing a drop in prices. In November 2015, Riyadh started selling its oil at a discount of 50% to market prices, and further increased the discount to 60% from January 1, 2016. Eventually, the discount was again raised to 1 USD/bbl on February 1. This factor provided a strong impulse for the slump in oil prices on world markets. Iran, in turned, also introduced discounts on its oil and sold its first discounted batches 1.5 USD/bbl cheaper than market prices for Iranian oil. However, in many ways, Iran is fully entitled to reclaim its share on global oil markets after the removal of sanctions against it.

It is important to note, as was reported in February, that the Iranian Oil Minister Bijan Namdar Zangeneh has stated Iran will support any measure aimed at improving the oil price situation, saying: «We welcome cooperation, both with OPEC member states, as well as with countries that are not part of that organization. The proposal, formulated yesterday in Doha, for OPEC members and other countries regarding a production freeze, was adopted with the aim of stabilizing the market and improving the oil price situation, and was agreed upon not just in the interests of consumers, but also oil producers». After a meeting with his Iraqi and Venezuelan colleagues, he further emphasized that he welcomed the idea of curbing output. At the same time, Iran could be offered specific conditions. The current coordination between Russia and OPEC member states might well be more efficient than cooperation achieved in 1998, 2001 or 2008.

It should also be mentioned that Leonid Fedun, Vice President and co-owner of one of Russia's largest oil companies, Lukoil, supported the position that capping oil production was necessary. He stated: «My personal opinion is that this needs to be done. Back in 1998, I was one of the initiators of negotiations with OPEC. At the time, the common position shared by Russia, Norway, Mexico and Saudi Arabia caused prices to turn around and we achieved an enduring upward trend». He also emphasized: «What is the rationale behind increasing output on the market at a time, when even small corrections in supply will lead to a price recovery, which in turn increases profits for both oil companies and the Russian Federation».

It requires mentioning that the Russian government can undoubtedly exercise leverage over Russian oil companies and the volumes they export: its means of leverage include oil export tolls, other taxes, including excise taxes on gasoline on the domestic market, as well as quantitative export quotas for private companies. The latter also depend on the government in relation to other issues.

At a briefing on March 1 of this year, President Vladimir Putin instructed that collaboration with the main oil-producing countries should continue, since not all had yet clarified their positions regarding the freeze of oil production. According to President Putin's press spokesman, Dmitry Peskov, Putin in the briefing clearly laid out his position concerning the Energy Ministry's proposal to maintain oil production volumes at January 2016 levels. The President also applauded the Ministry's efforts, conducted in joint work with partners in other states, aimed at keeping production at current measures. In a meeting with the President, Russian oil companies – including the heads of Rosneft, Lukoil, Gazprom, Bashneft, Tatneft, Zarubezhneft, Surgutneftegas, independent oil companies, as well as the head of the Kremlin's Chief of Staff Sergey Ivanov and the assistant to the Russian President Andrey Belousov – announced their support for the initiative to freeze output levels [1].

At the same time, since oil exports remain one of the most important sources of income for the Russian government, their restriction has to be approached extremely carefully. As pointed out by Stanislav Zhiznin, President of Russia's «Center of Energy Diplomacy and Geopolitics» (CED), the conception regarding Russia's and OPEC's interdependency was formulated back in 1997. Considering Russian objectives vis-à-vis OPEC, we are interested in a stable, predictable oil market and reasonably high prices. In this regard, Russian and OPEC interests coincide. Yet, OPEC also pursues the goal of enhancing its influence on the world oil market. Russia, eager to play the role of a global energy power, should respect that OPEC occupies an important position amongst global players. It is for this reason that Russia should further develop its relations with OPEC, at the same time taking into account the world's other players in the energy sphere [2].

3. A GCC Perspective

Omar Al-Ubaydli, Bahrain Center for Strategic, International and Energy Studies

Preamble: How Powerful is OPEC?

A sound analysis of oil markets requires an acknowledgement that OPEC’s historical power has been significantly exaggerated. The conventional view of OPEC, which is common to both policymakers and laypeople, is that it is a powerful cartel which distorts prices in its favor, and against the interests of oil importers. This view underlies much of the OPEC-based criticism that has recently been directed at Saudi Arabia over its refusal to cut output, as many commentators regard Saudi Arabia’s current oil policy as a significant deviation from the previous OPEC formula of coordinated output cuts and higher prices.

In a recent peer-reviewed paper, Jeff Colgan examined the behavior of OPEC and non-OPEC oil production in detail [3]. The data revealed that the output decisions of OPEC members, with the exception of Saudi Arabia (we return to this below), were statistically indistinguishable from those of non-OPEC members, once one controls for the technical and fiscal factors that determine oil production. For example, whereas OPEC countries such as Kuwait exhaust their reserves at a lower proportionate rate than non-OPEC countries, such as Oman, this is mostly down to the fact that the Kuwaiti government faces much lower fiscal pressure than the Omani one, and can therefore afford to be more forward looking. Moreover, in the period 1980-2009, production quotas were violated 96% of the time, and production decisions exhibited no statistical relationship with assigned quotas. Consequently, OPEC’s power is a myth.

Colgan also provides convincing explanations for the myth’s persistence. Two groups of the key stakeholders benefit directly from it: policymakers in OPEC countries acquire the prestige of appearing to hold the world economy by its throat, while Western policymakers have a readymade scapegoat for unfavorable oil prices.

Colgan’s data reveal that Saudi Arabia is an exception in that it does have significant market power and wields that power in an effort to satisfy some of its geo-political goals. For example, it likes to maintain an excess capacity which it can then deploy in the event that another major producer faces a supply disruption. This helps to maintain stable oil prices, which Saudi Arabia considers a service to the global economy, especially the USA.

If OPEC is actually a red herring, then it should come as no surprise: cartels are notoriously unstable even under ideal conditions. Forming a cartel in international oil markets is virtually impossible due to the difficulty of detecting cheaters, and the divergent cost structures and fiscal demands of the producers.

Recent developments in oil markets

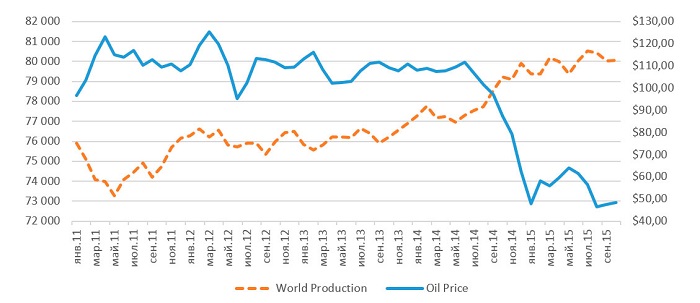

Figure 1 shows world oil production and prices (European Brent) for the period 2011-2015. Oil prices were pretty stable around $105 until the middle of 2014, after which they dropped rapidly to below $50 by the end of 2015 (they have since dropped below $30, before rebounding to around $40 during the middle of March 2016).

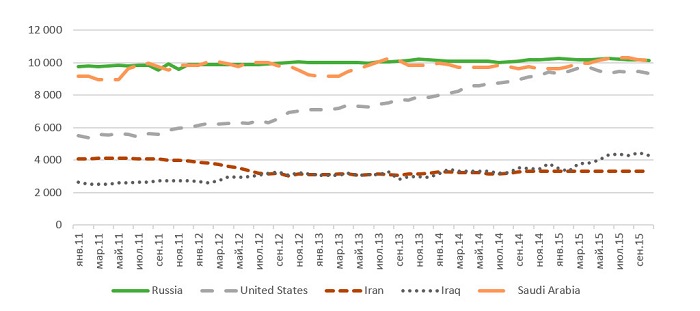

A quick glance at the world oil production series confirms that the explanation is more complicated than a mere increase in output. In fact, output increased by only around 3.5% during the period January 2014 – October 2015, or 2.7 million barrels/day. Figure 2 shows the output of a selection of major oil producers; it confirms that most of the increase in global production can be attributed to the USA (1.4 million barrels/day) and Iraq (1.2 million barrels/day). Contrary to popular belief, Saudi Arabia’s contribution to the rise has been anemic, equaling a mere 0.2 million barrels/day.

Prices, however, are not merely a function of current production; they also take into account future expectations. The above figures conceal the fact that Iran is planning on upping its production significantly after the lifting of sanctions, while Iraq also has plans to continue its strong production expansions. In the event that oil prices increase, US shale production is capable of continuing the strong growth shown in Figure 2. All these supply-side factors are helping to keep prices low.

Demand side factors are also playing a significant role. After the globe staged a mini-recovery to the financial crisis of 2008, the world economy has started to stagnate. The growth performance of two of the world’s largest oil importers, China and India, has been below par, while the European Union and Japan are both facing deep structural challenges that are limiting any contribution that they might otherwise offer to oil demand growth.

In addition to these straightforward changes in demand and supply, shale oil technology has fundamentally altered the market’s ability to respond to price changes. Under conventional oil production, the establishment and development of new wells takes many years, which is why traditionally, supply disruptions have led to sharp price increases. In contrast, shale oil wells are cheap and quick to initiate and suspend, rendering oil supply far more price elastic than before. Thus, OPEC’s preexisting weakness is accentuated by US oil producers in two ways. First, US oil competes directly with OPEC oil, especially now that the US’ self-imposed export ban has been lifted. Second, the more elastic market supply, the less profitable are output cuts.

OPEC and Russia

Prior to the shale oil revolution, Russia was the only top oil producer outside OPEC. In principle, this gave OPEC leeway to act unilaterally, or to have to coordinate with only one country (Russia) if it wanted to make sure that non-OPEC producers were not undermining OPEC output cuts.

Today, Saudi Arabia is the only top producer that is a member of OPEC, meaning that in the unlikely event that OPEC members were to actually coordinate their actions, the risk of their market share being stolen by other non-OPEC producers is higher than before. Involving US producers in any decision is off the table since they are decentralized private oil companies with managers that report to conventional shareholders. (OPEC members typically have national oil companies that answer to political decision makers.) Thus, in principle, there is a larger incentive than before for OPEC to coordinate with Russia.

When asked about the prospects of a coordinated output cut, Saudi Oil Minister Ali Al-Naimi has repeatedly insisted that Russia would have to be involved. In February 2016, several Gulf Cooperation Council (GCC) producers agreed to freeze production with Russia, giving oil prices a boost. (The attempt was shortly-lived as Iran quickly declared that it had no intention of freezing its output.) However, there remain several barriers to any OPEC-Russia or GCC-Russia cooperation on oil production.

First, Russia is perceived to be untrustworthy. (Whether or not it is actually untrustworthy is of second-order importance—perceptions are what dictate decisions.) In terms of oil, Saudi Arabia has cited a 1999 episode where it is generally thought that Russia agreed to cut output with OPEC, but ended up increasing its output.

Russia’s reputation for saying one thing and doing another is also based on perceptions about its behavior in non-oil areas. For example, in recent armed conflicts, observers have detected what they regard as inconsistencies between Russia’s officially-declared activities, and the activities that they are actually engaging in. From the perspective of some in the international community, the perceived inconsistencies have occurred on a large enough scale that they affect Russia’s credibility in other domains, including oil.

Even setting aside the issue of Russia’s trustworthiness, OPEC and the GCC countries are uncertain about the Russian government’s ability to control Russian oil production, due to the privatization of Russian oil companies after the collapse of the Soviet Union. While not as numerous as US shale oil producers, Russia’s oil companies have boards that answer to shareholders who might not wish to accede to the wishes of the central government. In fact, OPEC oil producers would be forgiven for expecting that Russian President Vladimir Putin would use this as an excuse after any non-compliance with a coordinated output cut is detected.

Maxim Suchkov:

The Middle East between the U.S. and Russia:

Potential Traps for Moscow

Even if Russia decided to keep its word, and its oil companies listened to government orders, the consequences are likely to be limited because of the barriers to OPEC coordinating its actions internally. As discussed above, OPEC has been ineffective for most of its existence, and its prospects for operating as a cartel at the moment are even less likely due to a host of fresh geo-political conflicts between its members. For example, after the Saudi Embassy in Tehran was stormed by suspected government-backed rioters in January 2016, Saudi Arabia severed diplomatic ties with the Islamic Republic. Saudi relations with Iran and Iraq are very negative at present, rendering the prospects of cooperation of any sort—let alone on oil production—incredibly dim. As such, the Russia question is essentially irrelevant.

Beyond OPEC’s troubles, US shale oil producers are also well-positioned to reactivate production in the event of an increase in oil prices. This poses another major barrier to any producers seeking to raise prices via a coordinated output cut.

Future Prospects

Falling oil prices have led to a collapse in oil investment, thereby guaranteeing a decrease in future oil production. Moreover, US shale oil bankruptcies are gathering pace, and US oil output is finally shrinking. These factors point to moderately increasing prices in coming two years. However, the looming threat of reactivating shale oil means that prices are unlikely to rise above $60/barrel.

The most important change is that oil markets now look very similar to the markets for any other competitive commodity. Any pretense over the ability of producers to coordinate their actions has been shattered by the price collapse. Shale oil has rendered the supply curve highly elastic, as have record levels of crude oil stored in various facilities across the globe. Moreover, as renewable energy alternatives, as well as natural gas, continue to expand, the demand for oil is becoming more price elastic, too.

In such a competitive environment, what OPEC, the GCC countries, and Russia think of each other, and what they hope to achieve together, is irrelevant. Producers will act unilaterally, and prices will reflect demand and supply fundamentals, without the complications posed by cartel activity.

1. Владимир Путин поручил продолжить работу по заморозке добычи нефти. Агентство нефтегазовой информации. 02.03.2016. //

2. Россия – ОПЕК: неиспользованные ресурсы взаимодействия. // Международная жизнь.

3. The emperor has no clothes: The limits of OPEC in the global oil market. JD Colgan - International Organization, 2014.

(no votes) |

(0 votes) |