Protectionism in Brazil is Back in Style

The President of Brazil. Dilma Rouseff

(no votes) |

(0 votes) |

MA, International Relations Pierre Mendès-France University, Post-graduate, UNICAMP University, Brazil

The rapid increase in the BRL exchange rate on international stock markets is jeopardizing the competitiveness of Brazilian companies abroad. The situation with regards to imports of Chinese products has become extremely acute, as national manufacturers are being forced out of the local market. The Government of Brazil has developed the “Brazil Maior” plan for 19 strategic sectors of the country’s economy. The plan includes trade protection measures: tax allowances, preferences in allocating government procurement contracts, soft lending conditions, etc. What are the benefits of the new economic line pursued by Brazil and how will it affect BRICS countries?

The rapid increase in the BRL exchange rate on international stock markets is jeopardizing the competitiveness of Brazilian companies abroad. The situation with regards to imports of Chinese products has become extremely acute, as national manufacturers are being forced out of the local market. The Government of Brazil has developed the “Brazil Maior” plan for 19 strategic sectors of the country’s economy. The plan includes trade protection measures: tax allowances, preferences in allocating government procurement contracts, soft lending conditions, etc. What are the benefits of the new economic line pursued by Brazil and how will it affect BRICS countries?

The economic model of import-substituting industrial development, which dominated in Brazil in 1950s-1970s, initially facilitated the development of national industry. However, the long-term results of such a policy, which led to a closed domestic market and eventually caused a lag in new technological adoption, are stagnation of production and low levels of competitiveness. Such risks are still present in the country, while maintaining high rates of economic growth for the further attraction of foreign investments still remains the government’s priority.

After a period of a relatively free economy of the 1990s, President of Brazil Lula da Silva (2003-2010) introduced a new course of economic growth in 2004 – a policy of industrial development which can be divided into three stages:

1. Between 2004 and 2008, a new program entitled “Industrial Policy, Technology and Foreign Policy” (Política Industrial, Tecnológica e de Comércio Exterior) was launched. This programme was bound to increase competitiveness of individual industries and services by advancing innovations and aiming to improve the quality of exported products.

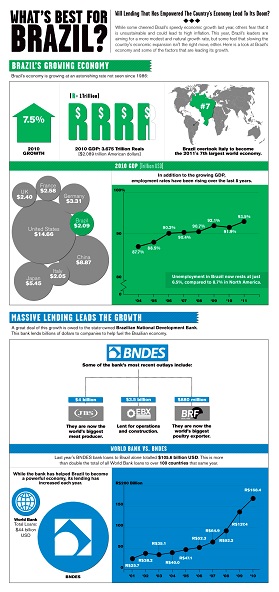

2. Following the course outlined in 2008, the government has announced the policy of growth in technology and basic industries (Política de Desenvolvimento Produtivo). Positioning of Brazil’s companies as world leaders in biofuels, mining, steel and aviation industries has become the government’s key strategy. It was Brazil’s National Development Bank (BNDES), founded in 1952 to facilitate the development of industry and infrastructure in Brazil that was entrusted to ensure monitoring over the achievement of the intended strategic objectives.

3. In 2011, soon after Dilma Rousseff was elected President of Brazil, she continued the policy of industrial development, introducing the new strategic plan “Brasil Maior”. The plan includes a series of measures aimed at protecting the domestic market from BRL revaluation and from increasing imports of Chinese products.

Key Protective Measures

In September 2013, on the eve of the G-20 summit, the European Commission released a report on potentially trade-restrictive measures over the last five years. According to the report, the majority of trade-restricting measures are still being applied in emerging economies, such as Argentina, Brazil, China and Russia. In 2008-2013, 688 new trade restrictions have been applied worldwide, whereas only 107 of the existing ones have been removed.

According to the reported ratings, Brazil ranks fifth in terms of the number of adopted restrictions: government procurement, measures to support exports and the introduction of preferential tax rates for production on the territory of Brazil. Such measures mostly affected the USA (chemicals, plastic materials, and natural rubber) and China (textiles, footwear and metals).

Customs tariffs were increased from 2% to 18% in over 100 product lines. In 2011, the government of Brazil raised the industrial tax for imported cars and trucks produced outside the Mercosur zone by 30%. As a consequence, Volkswagen, BMW, Audi and other world automobile manufacturers announced their interest in starting projects to manufacture vehicles in Brazil.

The government is pursuing the same policy in other industrial sectors, including oil and gas, as part of a plan to develop high-priced industries and create more jobs. Therefore through its financial and political leverage, the government is trying to replace imports of essential products with local production on the territory of Brazil, thus facilitating job creation and providing for additional budget revenues.

Trade between Brazil and China

Therefore through its financial and political leverage, the government is trying to replace imports of essential products with local production on the territory of Brazil, thus facilitating job creation and providing for additional budget revenues.

One of the reasons for increasing protectionism is intensifying trade relations with China, which dominates in foreign direct investment and is a major trade partner of Brazil, outpacing the USA and accounting for 75.5 billion USD of the total trade volume with Brazil in 2012. Whereas consumer demand remains high – in 2012, according to the Banco Central of Brazil, it has grown by 4.1% - the economy is losing the majority of profits generated by such demand. Imports of Chinese vehicles to Brazil increased fivefold over 2011. Since the start of 2013, Brazilian manufacturers have launched severe criticism over Chinese dumping policies of cell phones and footwear.

Despite the fact that trade with PRC has facilitated economic growth in Brazil, many experts believe that the onslaught of cheap Chinese imports has deteriorated the competitiveness of Brazilian companies worldwide and on the domestic market. As a result the protective measures apparently were intended to restrict Chinese imports. However, Dilma Rousseff’s government has made the localization of industrial goods production its priority and thus delivered a serious blow to the automobile manufacturing sector, China’s strategic industry.

Brazil’s trade relations with BRICS partners

The incompatibility of economic interests between BRICS members remains the most criticized aspect of BRICS. Their strategies of economic growth, focused as they are on export of primary commodities, are forcing them to enter into direct competition rather than complement each other. Indeed, trade statistics show that except for China, which has established close economic relations with all BRICS countries, trade operations between other partners remain insignificant. For instance, total trade turnover between Brazil and Russia totaled about USD 5.9 billion in 2012, 12 times less than that between Brazil and China.

On the other hand, it should be remembered that between 1990 and 2000, the total trade volume between BRICS countries increased from USD 28 billion to USD 418 billion. Nevertheless trade between members constitutes only a trifling volume compared to the total trade volume generated by each of the BRICS country with the EU, the USA and regional partners.

A more detailed analysis of trade relations between BRICS countries, excluding China, reveals that raw material industries and the lowest level processors are prevailing in their export and import structure. Brazil imports minerals and products of chemical industry from Russia (USD 2.5 billion out of USD 2.8 billion of total imports) and South Africa (USD 0.4 billion out of USD 0.8 billion of total imports). With regards to India, the import of minerals and agricultural products dominates as well; however the share of vehicles, equipment and pharmaceutical products is increasing (USD 3 billion and USD 0.8 billion respectively out of USD 5 billion of total imports).

Minerals and agricultural products continue to prevail in the structure of Brazil’s export to India as before (USD 2.7 billion out of USD 5.6 billion of the total exports). Exports to Russia include primarily meat, sugar and tobacco (USD 2.6 billion out of USD 3.1 billion of total exports), to South Africa – agricultural products including though a small share of automobile production (USD 1.2 billion out of USD 1.7 billion of the total export).

The governments of BRICS countries acknowledge the importance of diversification and strengthening economic ties within the association, and therefore a number of initiatives have been adopted to enhance trade: holding regular meetings between the Ministers of Trade of participating countries, international conferences on competition issues, business forums and other types of events.

Trade statistics show that except for China, which has established close economic relations with all BRICS countries, trade operations between other partners remain insignificant.

What will be the outcome of these initiatives? Dr. Oliver Stuenkel, Professor of International Relations at San Paulo University, is skeptical about the possibility of the signing of a free trade agreement in his article about trade relations between the BRICS countries. However, there is hope that numerous forums can remove various non-tariff barriers and facilitate trade between the countries.

Thus, the application of new protective measures by Brazil may adversely affect trade with BRICS partners (except for China), but only insignificantly, as such measures are primarily designed for the importation of industrial products. Brazil is pursuing an export-oriented policy and does not restrict trade in strategic minerals with its partners.

How Brazil’s Protectionism May Affect Russia-Brazil Cooperation

While agricultural imports (USD 2.2 billion) and exports of mineral fertilizer (USD 1.6 billion) dominate the Russian-Brazil balance of trade, the current policy of protectionism will hardly infringe on Russia’s interests.

It should be noted that according to statistics of bilateral trade over the last five years, Russian exports to Brazil have increased by 9% whereas Brazilian exports to Russia have dropped by 5%. It turns out that increasing protective measures in Brazil have not affected Russian exports. Perhaps the time has come for Russia to start more open trade with its BRICS partner?

To avoid possible adverse effects from protective measures on Russian exports in the future, an improvement of the Russian presence in Brazil is needed now. In our opinion there are three basic areas where trade and economic expansion can be accomplished:

First, political. BRICS and WTO summits (the latter now headed by General Director Roberto Azevedo of Brazil) serve as perfect venues for establishing dialogue, enhancing trade cooperation, signing agreements and forming the legal groundwork for simplifying trade procedures between the two countries.

Second, economic. Growing consumer demand in Brazil is having a favorable effect on the economic environment for business development. Like Russia, Brazil has succeeded in many hi-tech fields and is open to cooperation in this sphere. Many observers believe that the energy industry is the key platform for cooperation between BRICS countries, facilitating their position as an informal organization on the international scene. As a matter of fact, Brazil is open to investments in recently discovered deepwater oil deposits, while Russia has already announced its participation in the tender for a nuclear power station project on the territory of Brazil. However, to diversify its energy portfolio, Brazil is actively supporting and investing in the development of various renewable energy sources including biofuels, wind and solar energy which may serve as a “green” platform for exchanging experience and technology.

The governments of BRICS countries acknowledge the importance of diversification and strengthening economic ties within the association, and therefore a number of initiatives have been adopted to enhance trade: holding regular meetings between the Ministers of Trade of participating countries, international conferences on competition issues, business forums and other types of events.

Third, academic. Today Brazil is actively investing in educational and research projects. Joint scientific research and development, research and reviews of Russia-Brazil relations and possible spheres of cooperation, as well as the identification of trade barriers between the two countries are needed. Information awareness regarding the opportunities for Russian businesses in Brazil should be enhanced. For instance, recently the Brazil Foreign Office issued a guide on exports to Russia which is evidence that the government of Brazil supports developing bilateral cooperation. Russia for its part could facilitate awareness among businesses of export opportunities to Brazil, which would assist Russian entrepreneurs and facilitate bilateral trade and economic relations. The diplomatic presence of Russia in Brazil is not sufficient, while projects conducted by the Chambers of Trade and Commerce are still lagging behind those in Italy or France, for example, which does not correspond to economic realities on the world market.

Brazil’s current policy is designed to develop innovative technologies (IT) among national companies and to ensure that they prevail on the international market. The government is actively investing in IT and establishing the necessary legal foundation for developing domestic exports of products with high added value. BRICS partners may benefit from such policies and increase their presence on the world scene if they can intensify cooperation in the development of new technology and the diversification of mutual trade.

(no votes) |

(0 votes) |