Ties with the Arab world are important to Russia, and not only from the point of view of security: they could also boost the national economy. Tapping the potential of Russia-Arab cooperation would help Russia boost its GDP, and accelerate growth.

Foreign trade with Arab countries has potentially massive significance for today’s Russia. Arab countries are of interest to Russia as a market for domestically manufactured goods, technologies, metal products, and some raw materials on the one hand, and as a source of investment on the other.

Russia owes the position it enjoys in some Middle Eastern and North African economies primarily to the Soviet legacy. The Soviet Union was known for its substantial assistance to Arab states, helping them with large infrastructure projects, the power industry, metallurgy, engineering, and defense rearmament, all of which are currently in need of modernization. In the 1950–1980s, the company Tekhnopromexport built eight thermal power and combined heat power stations and eleven hydropower plants in Arab countries.

After a long period of decline during the 1990s, in the 2000s, Russian-Arab trade and economic links started to pick up, aided by the attention the Russian leadership paid to the Arab world and, in particular owing to visits presidents Vladimir Putin and Dmitry Medvedev made to the region (Putin visited Algeria in March 2006, and Medvedev in October 2010).

Russia is seeking to regain a significant presence in the markets of those countries that have traditionally been Soviet partners, such as Algeria, Libya, Syria and Iraq, and also to enter the markets of the Arab monarchies in the Persian Gulf.

Arab Countries as Markets for Russian Goods

In 2011, Russian-Arab trade increased 38 percent on 2010 levels to reach $ 14 billion, higher than before the economic crisis. Trade turnover is expected to continue to grow in 2012, albeit at a slower pace. However, despite obvious progress, Arab countries have not become Russia’s key trade partners, and their share in Russia’s foreign trade stands at about 2–3 percent.

At the same time, Arab countries may be important for Moscow as a market for domestic and industrial goods, since Russian exports make up more than 90 percent of trade with them. Russia’s exports differ widely country-to-country. Exports to the United Arab Emirates, for instance, predominantly comprise precious metals and stones, metal products, machines, equipment, and transport vehicles, whereas the bulk of Russian exports to Morocco are oil and petroleum products, coal, sulfur, metals and chemical goods.

Arab countries continue to show a demand for Russian-produced arms and armaments, traditionally known for their high durability in comparison with Chinese products, and for being cheaper than similar Western makes. According to the Centre for Analysis of World Arms Trade, recent figures show that Arab countries remain significant arms buyers – making up 14 percent of Russia’s arms exports.

Russia’s growing trade with Arab countries in high value-added goods helps remove imbalances in the general structure of Russia’s exports, and also supporting Russian enterprises with new orders.

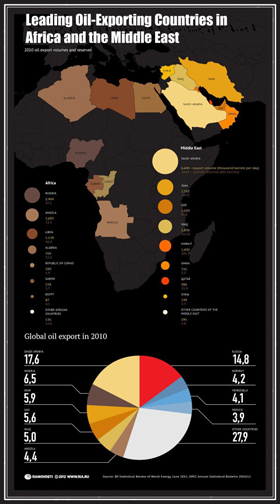

Mineral Resources: Competitors or Partners?

Russia and certain Arab states are major suppliers of fuel to global markets, and they may be competing against each other for consumers. Both are rich in hydrocarbons, and have a vested interest in keeping oil prices high in export markets. And they can act as partners in that regard.

In the power sector, they cooperate in hydrocarbon exploration and infrastructure construction, while other opportunities to explore could be technological exchanges, joint projects in third countries or participation in the privatization of state-owned enterprises in the power sector.

Other Promising Areas for Cooperation

There are good grounds for economic and technological cooperation in areas such as electricity generation, nuclear and renewable power, various manufacturing industries, metals, defense, water management, construction and agriculture.

One promising area for trade and economic cooperation is in technology exchanges. Arab states seem interested in using Russian expertise and technologies in sectors including oil and gas production, petrochemicals, remote sensing, water demineralization, nuclear power, space and IT. In 2012, Russian’s Tekhnoexport and Russian-controlled Canadian Uranium One Inc. committed themselves to a uranium conversion and recycling (into reduced-enrichment fuel) project for four nuclear stations in the United Arab Emirates.

Arab Countries as a Source of Investment in Russia

Arab monarchies such as those in Saudi Arabia, Kuwait, the United Arab Emirates (UAE), Qatar, or Bahrain could be major sources of long-term capital for developed and emerging economies alike. For instance, UAE investment funds are believed to manage over $ 1 trillion.

These countries’ investment for Russia has to date gone virtually untapped, although Russia has had some success mobilizing resources from the Arab world. At the 2010 Sochi Forum, the state-owned corporation Rostekhnologii signed an agreement with a seaport operator Gulftainer Company Ltd. to set up a $ 500 million Fund to invest in infrastructure projects, and another agreement with the developer Damac Holding to establish a $ 300 million fund to invest in real estate projects. In 2011, Gulftainer Company Ltd. acquired co-ownership of the Ust-Luga seaport terminal. The company has also shown some interest in investing in the South-2 handling terminal.

There is no public data on the exact amount of “Arab investment” in Russia. Any estimates are difficult because Russian capital sometimes returns disguised as investment from Arab states, in particular the United Arab Emirates. However, according to official Russian statistics, Arab countries are still far from being major investors in the Russian economy. The key reason is the unfavorable investment climate. Most investors in the Arab world view Russia as a high-risk market.

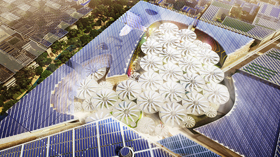

However, investment from the Arab world could facilitate the modernization of the Russian economy. Apart from their capital, Arab countries have expertise in establishing and managing free economic zones, seaports, infrastructure and certain advanced technologies. There is definite promise in bringing Masdar in from the Emirates to help Russian alternative energy projects.

The irony of today’s Russia is that, despite this clearly defined interest in raising foreign investment capital, business links with Gulf monarchies as potential investors are evolving too slowly.

What Obstructs Better Cooperation?

There are a number of factors that appear to impede the potential of the Russian-Arab trade and economic cooperation, and the key ones are:

- Production output in Russia has declined, with the range of export goods shrinking since the days of the USSR;

- Arab countries tend to be integrated in various regional associations, thus keeping new entrants from the markets;

- Russian competitors rely on Arab lobbies that also tend to promote Western business interests;

- Instability in some Middle Eastern and North African countries; and

- Political relations with certain Arab countries have been deteriorating as a result of differences over Syria.

Other problems that obstruct the further development of Russian-Arab trade include a laco of transport infrastructure, goods potentially attractive to Russian consumers, and the complexities of Russia’s visa procedures.

It is unfortunate that, for various reasons, Russian businesses seem to be losing their foothold in those Arab industries that we traditionally considered “ours.” Some Western and Chinese competitors have succeeded in squeezing Russian business out of the metals industry and power infrastructure construction sector in Algeria, although it is in Algeria that a significant majority of nationally important facilities were built with Soviet assistance: the Annaba metallurgical plant, the Jijel thermal power station, the Alrar-Tinfuye-Hassi Messaoud gas pipeline, the Beni Zid and Tilezdit dams, and some of the El Hajar steel works facilities.

Russian Business in Arab Countries: Where May Government Help?

To foster trade and support the economic positions held by Russian companies on the export markets, including in Arab economies, the Russian government has developed a system of measures to offer state support to industrial exports. These policies rely on trade and economic, logistical, financial and advisory tools, as listed on the foreign trade website of the Russian Ministry for Economic Development.

One of the key measures that could be used to support Russian exporters in Arab countries is the Russian Agency for Export Credits and Investments Insurance (EXIAR), established in 2011. It provides insurance coverage to export loans, goods, services and investments covering up to 95 and 90 percent, respectively, of political and commercial risks. Commercial risks include bankruptcy or insolvency of Russian exporters’ counterparts.

There is reason to believe that EXIAR can promote Russian business in parts of the Middle East and North Africa where no major Russian insurers have so far been represented.

Interviews with local businesses that trade with Arab countries shed light on some of the issues that they face most frequently. The Russian authorities could offer extended assistance to national businesses, including:

1. Providing regular business information

There is still a proven need to provide regular briefings to state-owned and private Russian companies on the latest developments in the economy, local markets, and actions by potential competitors. This could help Russian entrepreneurs by ensuring they understand licensing procedures in host countries, the terms and conditions of project financing, procedures for title registration, etc. Detailed business information is still difficult to find, since there are only three Russian trade missions in the Arab world – one in Algeria, one in Egypt and one in Morocco.

Today, Russian embassies to Arab countries traditionally focus on political issues and, significantly, much less on economic ones. However, in Arab countries the high officials are not always the key decision-makers. Contacts between Russian embassies and influential local elites might better promote the business interests of Russian state and private companies.

It is essential to set up some local source of information, which, upon request, could offer timely analytical reports, assess the risks of and prospects for economic cooperation between Russia and Arab countries in specific areas, or provide briefings on the unique features of the Arab world.

Not infrequently, Russian businessmen are unaware of the specific features of the Arab countries in which they intend to work. Without knowledge of local traditions, specific culture and social fabric, you will never be regarded as a reliable partner.

Collecting, collating and processing a huge set of data on the prospects for scientific, technological and industrial development in Arab countries could be a task for Arabic scholars at the Institute of Oriental Studies of the Russian Academy of Sciences, the Institute of the World Economy and International Affairs, the Institute for Foreign Relations of the Russian Ministry for Foreign Affairs (MGIMO University), the St. Petersburg Institute of Oriental Studies or other Russian centers focusing on economic aspects of the Arab region. These advisory services could be offered on a commercial basis.

2. Improved contractual and legal framework

Russian relations with most Arab states are based on framework cooperation agreements. In some countries, packages of agreements governing trade and economic issues have not even been signed: for instance, investment protection agreements have only been signed with eight Arab states.

Given this situation, Russian business tends to incorporate their subsidiaries in jurisdictions enjoying better contractual and legal relations with Arab countries. It is because of the absence of double tax treaties between Russia and Algeria that Gazprom’s subsidiary operating there, Gazprom EP International B.V., was established in the Netherlands.

3. Easing visa procedures for Arab businessmen

It is essential to simplify the visa regime and administrative procedures for Arab businessmen working in and with Russia, as this would ease hosting business negotiations in-country.

To summarize, while Russian companies tend to play a key role in protecting their own business interests, better coordinated actions by supporting agents of Russian-Arab trade and economic relations; the facilitation of regular and swift information sharing; timely support to Russian exporters; and easing the visa regime for Arab businessmen would lend an important impetus to improved business relations between Russia and the Arab world.