The key to understanding the current state of affairs in Russia-Ukraine gas relations is in the fact that Kiev is simply bankrupt. Both the Ukrainian government and Naftogaz have been slung over the barrel, primarily because low domestic prices are not bringing in enough revenue.

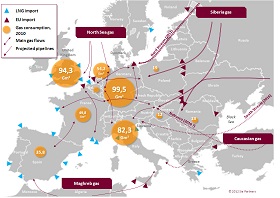

The sense of insecurity may as well prompt European politicians to revise their approach to the South Stream project designed to provide the EU with an alternative gas supply route.

The key to understanding the current state of affairs in Russia-Ukraine gas relations is in the fact that Kiev is simply bankrupt. Both the Ukrainian government and Naftogaz have been slung over the barrel, primarily because low domestic prices are not bringing in enough revenue. The Ukraine gas price set in 2009 is commercially viable and then basically on par with other European consumers. In recent years, Gazprom made some concessions to other European countries, making current contracted price for Ukraine now higher than the European average. However, the Russian offer to deliver gas to Ukraine at USD 385 per 1,000 cubic meters, i.e. at a 20-percent discount, reflects changes in the European market and fully matches Gazprom prices for European countries. The alternate price suggested by Kiev is absolutely groundless.

As far as the overall gas settlement is concerned, the heart of the matter seems to lie in the approach of the European Union. Fortunately, Brussels today is deeply involved in gas negotiations between Russia and Ukraine in contrast to 2006 and 2009, when the Europeans deliberately avoided any kind of participation in such processes. But nowadays they appear to be seriously worried about their own continuous gas supply during winter.

The deeper they get involved in the details of the Russia-Ukraine dialogue, the clearer they perceive Kiev's attitudes and negotiating capacity. Of principal importance for Moscow are not just the agreements per se, but also firm European guarantees that Ukraine will honor its commitments. Any accords on prices, debt servicing schedules and future gas payments will be rendered meaningless in the absence of similar guarantees on the part of the European Union, among other things because Brussels provides Kiev with funds and without this financial aid, Ukraine will be insolvent toward both future deliveries and debt servicing.

In a nutshell, Russia's interests include the continuation of the 2009 contract terms, gas sales to Ukraine at a commercial price adjusted to the European market in recent years with no political concessions, receipt of funds to offset at least some of the Ukrainian aggregate debt, and a strict debt servicing schedule with the EU guarantees that Ukraine appropriately will channels European allocation. Notably, the time to reach such an agreement is very short, since nonstop deliveries of Russian gas to Europe in winter will require pre-pumping substantial gas volumes into storage in Ukraine. In practical terms, an agreement must be in place by the middle or, at the latest, by the end of September. Otherwise, Europeans will have to bet on a warm winter.

Finally, the reliability and stability of any gas agreement with Ukraine will crucially depend on long-term reconciliation in southeastern Ukraine. European consumers, particularly businesses, are becoming increasingly aware of the complexity and unpredictability of Russian gas transit across Ukraine. Hence, the sense of insecurity may as well prompt European politicians to revise their approach to the South Stream project designed to provide the EU with an alternative gas supply route.