A Half-Step from the Abyss: Belarus’s Economy Ahead of Presidential Elections

In

Login if you are already registered

(votes: 1, rating: 5) |

(1 vote) |

Economics Expert at Discussion Society Liberal Cub, Belarus

The optimistic statements by top officials in Minsk do little to conceal the fact that the economy of Belarus is in dire straits. Although they are doing their best to justify the trouble with references to numerous external factors, the real cause lies in the obsolete model of development based on the dominance of state ownership and Russian resource assistance.

The optimistic statements by top officials in Minsk do little to conceal the fact that the economy of Belarus is in dire straits. Although they are doing their best to justify the trouble with references to numerous external factors, the real cause lies in the obsolete model of development based on the dominance of state ownership and Russian resource assistance.

Since early this year, Belarus GDP has been in the red zone, which is quite strange because previous growth rates reached at least 3-5 percent. As such, the drop in GDP of 3.3 percent during the first half of this year is quite unique, since a similar plunge of over three percent took place 19 years ago, i.e. in the first quarter of 1996.

The Belarusian Ministry of Economy insists that in the final months of this year, economic growth will improve, with a target figure remaining at the planned level of 0.2-0.7 percent. However, international organizations continue to give negative scenarios. Last April the IMF forecasted a GDP decrease of 2.3 percent, last May the EBRD predicted minus 2.5 percent, last June the World Bank forecasted minus 3.5 percent, and the European Economic Commission – minus 4.2 percent.

With regards to the economy, it does not seem relevant whether Belarus has a 3.3-percent drop or a 0.7-percent rise, because the country is deep into a long-term negative trend. While over the two past five-year periods, the country's GDP has held at 107.5 percent (2001-2005) and 107.3 percent (2006-2010), in 2011-2015 the average figure should be 102.1 percent at best with the same level of Russian energy subsidies estimated by the World Bank at about 13 percent of GDP.

Hence, Belarus’s economic troubles are far from temporary and are being generated by the outside world, testifying to a full-scale crisis, which conceals a host of risks for the country's future.

Systemic Calamity

Belarus is facing both transitory and structural crises of state management.

Belarus is facing both transitory and structural crises of state management.

The transitory element lies primarily in Russia's economic recession which has been aggravated by low oil prices. Late in the second quarter of 2015, Russian GDP decreased by 4.6 percent, i.e. by a much greater than against the forecast given by the Ministry for Economic Development in March 2015.

The contraction of the market in Russia, Belarus’s main trading partner, has caused a drop in foreign trade: this January-May, Belarus's overall export of goods dropped by 28.3 percent or by USD 4.4 billion against the same period of 2014, and to Russia – by 34.8 percent or USD 2.1 billion. Officials explain the trend by referencing changed prices, which seems hardly plausible.

According to Belstat, during the first five months of 2015, the overall export index amounted to 99.5 percent of the 2014 level, with the average price index dropping to 72 percent. But in trade with Russia, Belarus has shown a 17.2-percent plunge in export volume (much deeper vis-à-vis other countries), with the average price index plummeting only to 78.8 percent.

Since early this year, Belarus GDP has been in

the red zone, which is quite strange because

previous growth rates reached at least

3-5 percent.

As for trade beyond the CIS, where Belarus delivers most of its oil products, the export value has plunged by 32.3 percent, while supplies have grown by 24.9 percent. Removing the energy component from these figures shows that the value increased by 13.4 percent and the volume gained 8 percent, which means that the global oil price drop over the past 12 months has cut Belarus's currency revenues from oil product sales by more than 50 percent. Losses have been compensated by more deliveries, among other things by diverging the flows of obligatory oil product sales from Russia to Europe.

Thus, one can barely say Belarus is welcome on foreign markets, something Minsk is eager to reverse.

The authorities believe that export expansion, mainly at the expense of smaller countries with smaller domestic markets, may improve the situation, although compensating the USD 4.4 billion loss through this strategy in the short term may be a pipe dream. The long-term absence of the lost currency revenues may even exacerbate the predicament.

This wait-and-see strategy is also not acceptable because it will make Belarus’s economy more dependent on external factors.

The same refers to hopes for making a quick buck from investment projects implemented under the modernization program. Some of these require government support due to insufficient demand for produced items. For example, despite almost USD 2 billion injected into woodworking, in the first half of 2015, production in this sector fell by 4.1 percent, whereas warehoused products are already above the monthly norm.

The quick restructuring of the production sector is impossible in an atmosphere of apathy, indifference and corruption.

The cement industry received a little above USD 1 billion in hopes of reaching a production level of 9.5 million tons and export 4.3 million tons. However, in the first six months, the Belarusian plants turned out only 2.1 million tons of cement, i.e. 84.1 percent against the previous year, while exports plummeted by almost 40 percent during these five months. According to Belarusian Finance Ministry data, in the first quarter, the net losses of the three key cement producers – Belarusian Cement Plant, Krichevcementoshifer and Krasnoselskstroymaterialy – reached 119.3 billion rubles.

The speedy adaptation of state enterprises to the new situation is unlikely. The quick restructuring of the production sector is impossible in an atmosphere of apathy, indifference and corruption, while government factories generate up to 70 percent of overall output, underlying the presence of a structural crisis that is tightly connected to the crisis of governance.

The latter can be summarized by the words of President Alexander Lukashenka voiced during the April 2015 discussion held with his chief-of-staff Alexander Kosinets: "There seems to be something more than impressions but rather grounds for conclusions concerning the efficiency of the Presidential Administration… Some officials must be told twice to make them fulfill President's instructions on burning issues."

External Matters

The third quarter of 2015 will be a major test for Belarus. With presidential elections looming, economic logic often tends to be replaced by political populism, which hampers responses to emerging challenges.

The external challenges, which are hardly manageable by Minsk and may affect developments in Belarus in the second half of the year, include a deeper recession in Russia and a drop in the oil price to under USD 50 per barrel.

The first parameter requires complex analysis rather than concentrating on possible changes in the rate of the ruble, and early in 2015 after the turmoil in the currency, the Belarusian Ministry of Economy offered scenarios for the country's economic future with a focus on oil prices and the behavior of the ruble.

However, the crisis in Russia's economy may bring not only the devaluation of the Russian ruble but also compression in domestic demand and consequently the removal of Belarusian goods from the Russian market. Russian programs of import substitution – increasingly popular after the sanctions war with the West broke out – will create more pressure on Belarusian goods. Although in January-May 2015 Belarus has already decreased Russia's share in its exports from 39.9 to 36.2 percent, the year-end figures could be even lower. Hence, another portion of currency revenue, which seems critical in an unbalanced economy, is going to be lost.

The external challenges, which and may affect developments in Belarus in the second half of the year, include a deeper recession in Russia and a drop in the oil price to under USD 50 per barrel.

The protectionism intrinsic to Russia during bad economic times also damages Belarus. The Eurasian Economic Union notwithstanding, this year the number of nontariff barriers for Belarusian goods has grown. Amidst a Russian struggle against Western exports, Belarusian producers are also suffering because of restricted access to neighboring markets. Official statistics do not show any major gains for Belarus following Russia's embargo being placed on certain European items despite widespread opinion of the contrary.

An integrated analysis of the consolidated positions of the Foreign Trade Classification of Goods of the Customs Union applied to the Belarusian export items included in the list of goods prohibited for entry to Russia indicates that Belarus has not received any additional profits. In the period of last January-May, the share of items on the sanctions list exported from Belarus to Russia increased from 24.9 to 30.7 percent, mainly due to meat and dairy products. But money in terms of their export dropped by 16.6 percent from USD 1.59 billion to USD 1.33 billion.

Beginning in the mid-2000s, the oil price has become a special factor for the Belarusian economy because the country has only minor oil reserves and grew dependent on the processing and selling of Russian oil.

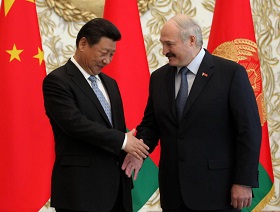

In order to rectify the situation, Minsk is likely

to diversify its money sources, attracting new

countries and organizations, as one can see from

emerging close cooperation with Beijing.

Currently, mineral products make up one third of currency revenues, with 15 percent more accounting for chemical products. No wonder, Minsk has been deprived of a major share of currency inflows after the oil price plunged from the three-digit to two-digit values.

However, this has not been the main trouble. According to the intergovernmental Belarus-Russia protocol signed in late 2014, in 2015 all of the oil product export duties remain in the Belarusian budget. On the day of the signing, Minsk could count on receiving over USD 2 billion, but after oil plummeted to USD 50 per barrel, this year revenues may amount to only USD 1 billion. If the prices keep dropping, the Belarusian budget is going to lose several million dollars more.

The diminished budget revenues due to external factors are delivering Belarus a strong blow. As of the end of the first quarter, the share of foreign trade taxes in the consolidated budget has grown to 18.7 percent against the previous year. As a result, the budget enjoyed a surplus of 4.1 percent of GDP amidst a worsening financial situation for enterprises. The surplus is significant because it is intended to be used to repay part of the foreign debt that should peak in 2015. Otherwise, Minsk will have to use its depleted domestic reserves.

In a nutshell, Minsk is not able to manage the external threats. While relations with Russia can help settle some matters politically, a drop in the oil price is inevitable. Hence, mechanisms are badly needed to help the economy quickly adjust to the changing environment. But Minsk insists on a simplified account of external factors and a minimization of losses from the growing domestic risks.

Domestic Limits

The weakest point of the Belarusian economy lies in the backlog between intermediate outcomes of monetary and credit sector reform and slow changes in the development of the real economy. Measures taken by the National Bank to ensure macroeconomic stabilization have lowered risks in the financial sector. But the government seems unwilling to alter approaches to managing state enterprises and granting more liberties to private businesses, which gives rise to a dilemma: further monetary and credit reforms are hampered by a weak real economy, while no political will is seen to reform the latter.

The crisis in Russia's economy may bring not only the devaluation of the Russian ruble but also compression in domestic demand and consequently the removal of Belarusian goods from the Russian market.

This conundrum makes further economic aggravation more probable.

A major risk in the next few months is a repeat loss of popular trust in the banking sector. The National Bank is working hard to bring down interest rates on the credit and deposit market to help enterprises increase their working assets through cheap loans. But this approach may trigger a chain reaction related to the outflow of liquidity from banks.

As of July 1, 2015, the savings accounts of individuals, the most vulnerable category of depositors, held 34.3 trillion rubles.

The figure makes up about 62.5 percent of fixed-term deposits in the banking system. These sums may be withdrawn if banks lose their attractiveness. Judging by the nature of savings, this money will not go to consumption, as the Belarusians will rather convert their rubles into foreign currency, only to increase pressure on the exchange rate.

In trouble, Russia may come to the rescue,

once again giving Belarus credits on privileged

terms. However, such programs are politically

motivated.

In addition, the withdrawal of money from banks may be also caused by a sharp change in the exchange rate caused by external factors. In this case, a domino effect may occur.

One more genuine risk lies in the condition of enterprises. In absolute terms, the number of unprofitable organizations last May (the most recent month covered by financial statistics) has seriously grown to 135.5 percent against the previous year (125.2 percent in April). At that, their share of the total number of organizations remains at an approximately the same level, i.e. 21.5 against 21.3 percent. Including low-profit enterprises (up to 5 percent), over three fourths of the economy is operating at minimal efficiency.

The government is trying to reduce financial pressure on enterprises but under restrictive credit rates, these measures appear to be destructive. In fact, the government is taking up the commitments of enterprises (including foreign currency obligations) and supporting them with help of debt instruments (bonds, etc.). However, these measure cannot solve the problem of low efficiency. So, in the medium term, expect more problematic loans to banks and another spiral of inflation.

Analysis of the consumer price index (CPI), the key parameter in inflation dynamics, may produce an impression that the problem is being gradually handled. Since early 2015, monthly CPI figures dropped from 2.4 percent in January to 0.2 percent in July. Nevertheless, prices are rising slower not only because of the National Bank's tough policies, but rather due to manual control of the process by the Trade Ministry. After the devaluation in January 2015, the government is if fact controlling prices through prudential measures applied to those who tend to raise them without grounds.

In a nutshell, Minsk is not able to manage the external threats.

At that, since March 2015, the index of prices on goods and services beyond the basic CPI was in the negative, which partly means that the government has also frozen state-regulated prices and tariffs. Accordingly, under conditions of higher annual inflation (planned at 15-18 percent), the canopy should be removed. The question is when this may happen.

On the whole, domestic economic risks are legion, with more to be added:

- Depletion of currency reserves versus high foreign debt.

- Reduction of SME numbers.

- Rising unemployment and part-time employment.

A Leveling Factor?

Although economic bottlenecks are numerous, presidential elections may be a leveling factor.

A major risk in the next few months is a repeat loss of popular trust in the banking sector.

No doubt, the time will come when economic laws prevail over political wishes, although currently administrative levers can be used to improve the system's parameters. The approach requires resources, while Belarusian reserves are emaciated – the National Bank accounts may boast as much as USD 2.5 billion.

In trouble, Russia may come to the rescue, once again giving Belarus credits on privileged terms. However, such programs are politically motivated, as Minsk has to repay both in cash and international positions, which happens to be inevitable to hold the economic situation under control.

Government is trying to reduce financial pressure on enterprises but under restrictive credit rates, these measures appear to be destructive. In fact, the government is taking up the commitments of enterprises (including foreign currency obligations) and supporting them with help of debt instruments (bonds, etc.).

Money can be made available from international organizations that do not demand political concessions but insist on market reforms, which are hardly popular in the Belarusian establishment. However, previous years indicate that generous creditors may be sold promises of reforms. Besides, one may also roll them back.

In order to rectify the situation, Minsk is likely to diversify its money sources, attracting new countries and organizations, as one can see from emerging close cooperation with Beijing. The ploy is valid for both getting cash and preserving sovereignty.

Nevertheless, the risks for the Belarusian economy will remain and may acquire greater significance, probably worsening after the elections. Even scarce data for this year will hardly create the illusion of macroeconomic parameters being improved, since loans cannot change the socio-economic model in the absence of the political will.

(votes: 1, rating: 5) |

(1 vote) |