On April 2, 2025, President Donald Trump announced a bold escalation in U.S. trade policy, imposing a baseline 10% tariff on all imports and a specific 20% tariff on goods from the European Union (EU), up from the previous average tariff rate of 3.5%. Framed as a countermeasure to persistent trade imbalances, this protectionist move has elicited sharp reactions from German legacy media, cartel party politicians, and mainstream economists, who have dismissed it as irrational, even labelling Trump and his advisors as either economically ignorant or mentally unfit. Yet, the policy reflects a calculated strategy rooted in economic data and geopolitical objectives. The following article dissects the rationale behind Trump’s “tariff hammer,” evaluates its economic foundations, the Mar-a-Lago Accords, and broader implications and consequences of the U.S. retreat for U.S. allies, particularly Germany.

Trump’s tariff hammer and the Mar-a-Lago Accord form a strategic triad—protectionism, fiscal relief, and geopolitical leverage—to reboot U.S. hegemony. Addressing deindustrialization, a 127% GDP debt, and military overextension hinges on correcting the dollar’s overvaluation, which tariffs, and the accord seek to negotiate down. Trump’s "America First" genius, far from being ignorant or mentally unfit, lies in wielding economic and military tools with calculated determination.

For Germany and European patriots this poses a dilemma. While Trump aligns culturally against globalist ideologies, his policies burden allies economically, demanding concessions under fairness pretexts. Germany must eschew illusions of mutual benefit, instead forging a "Germany First" path—restoring sovereignty, industry, and independence from Brussels and Washington through strategic self-reliance, inspired by Trump’s model yet distinct in execution.

Introduction

On April 2, 2025, President Donald Trump announced a bold escalation in U.S. trade policy, imposing a baseline 10% tariff on all imports and a specific 20% tariff on goods from the European Union (EU), up from the previous average tariff rate of 3.5%. [1] Framed as a countermeasure to persistent trade imbalances, this protectionist move has elicited sharp reactions from German legacy media, cartel party politicians, and mainstream economists, who have dismissed it as irrational, even labelling Trump and his advisors as either economically ignorant or mentally unfit. Yet, the policy reflects a calculated strategy rooted in economic data and geopolitical objectives. The following article dissects the rationale behind Trump’s “tariff hammer,” evaluates its economic foundations, the Mar-a-Lago Accords, and broader implications and consequences of the U.S. retreat for U.S. allies, particularly Germany.

Trade Imbalances and Justifications

The United States currently runs a current account [2] and balance of payments deficit with the EU, which, though narrowed since 2020—likely due to rising U.S. digital service exports and German industrial decline—remains significant. [3] This deficit weakens domestic manufacturing competitiveness, contributes to factory closures, and increases U.S. dependency on foreign supply chains. Trump justifies the 20% tariff on EU goods as a reciprocal measure, arguing that the U.S. faces unequal treatment in transatlantic trade, driven by stricter EU trade barriers and an undervalued euro that provides European exporters an artificial edge.

Tariff Levels and Sectoral Disparities

While average tariffs are comparable—4% in the EU versus 3.5% in the U.S.—sector-specific differences reveal a starker imbalance:

- Automobiles: The EU imposes a 10% tariff on U.S. cars, compared to the U.S.’s 2.5% on EU cars. [ 4]

- Food and Beverages: U.S. exporters face a tariff gap of 3–3.5 percentage points higher than their EU counterparts. [ 5]

Non-Tariff Barriers (NTBs)

Beyond tariffs, non-tariff barriers (NTBs)—including import quotas, subsidies, strict regulations, bureaucratic customs procedures, safety standards, local content rules, and environmental restrictions—impose significant hidden costs on U.S. exporters. These NTBs are notoriously difficult to quantify but undeniably amplify the trade disadvantage.

Currency Misalignment

A pivotal factor in Trump’s justification to the trade war is currency valuation. A purchasing power parity (PPP) analysis indicates that the U.S. dollar is overvalued by approximately 15% against the euro, making American exports to the Eurozone 15% more expensive and EU imports to the U.S. correspondingly cheaper. [6] Whether this misalignment stems from deliberate manipulation or structural factors tied to the dollar’s global reserve status is a question explored later.

Quantifying Trade Barriers

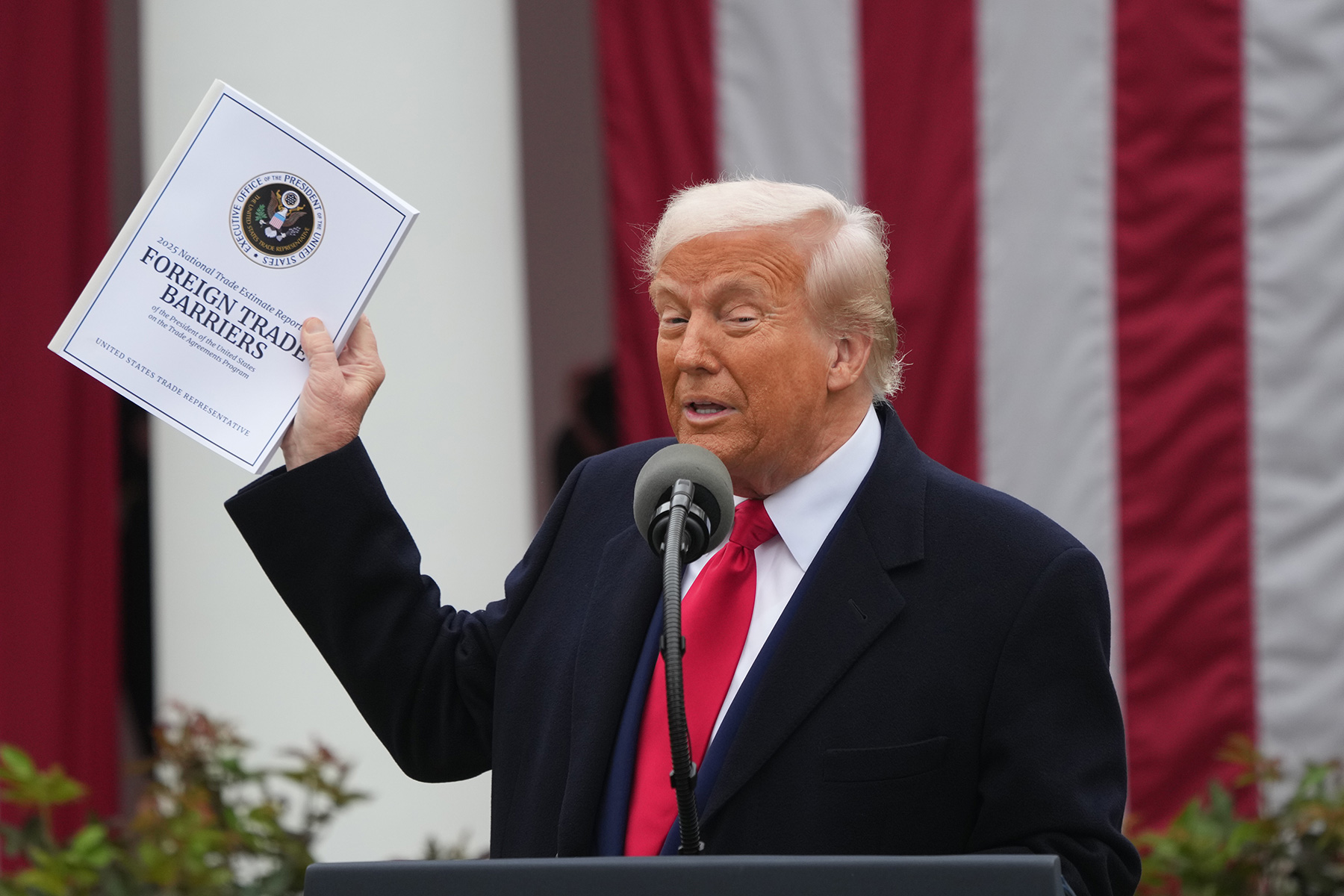

During thee notorious Rose Garden briefing, Commerce Secretary Lutnick presented a chart, claiming that EU-imposed costs on U.S. goods total 39%, framing the 20% U.S. tariff as a moderate response. The White House has not detailed the methodology behind this figure, but it appears to encompass tariffs, NTBs, and currency effects. [7]

The White House Estimate

The 39% figure is likely derived from:

- A 4% average EU import tariff.

- A 15% export price markup due to the overvalued U.S. dollar.

- An estimated 20% ad valorem equivalent (AVE) for European NTBs on U.S. products.

Contrasting this, research by economist Mahdi Ghodsi of the Vienna Institute for International Economic Studies (wiiw) estimates the AVE of NTBs faced by U.S. exporters in the EU at just 2.8%. [8] Adding this to the 4% tariff and 15% currency distortion yields a total trade barrier of approximately 21%—half the White House’s claim but still exceeding the new 20% U.S. tariff on EU goods.

Trade Costs for EU Exporters

To assess reciprocity, consider the barriers faced by European exporters, such as German carmakers, in the U.S. market:

- A United States International Trade Commission meta-study pegs average U.S. NTBs on foreign exporters at 13.3%, [9] though Ghodsi’s bilateral estimates suggest EU exporters face only 1.8%.

- The euro’s undervaluation provides a 13% price advantage for EU goods in the U.S., acting as a negative trade barrier.

- Combining the 3.5% U.S. tariff, 1.8% NTB AVE, and 13% currency benefit, the total cost burden for EU exporters ranges from 4% to a potential negative 8%, implying a profit advantage under current conditions.

Even with the new 20% tariff, EU exporters face total barriers of 9% to 20%, still below the 21% estimated for U.S. exporters in the EU. This disparity underscores Trump’s argument for levelling the playing field.

Strategic Objectives of the Tariff Policy

Trump’s tariff policy pursues three interlinked goals:

Reindustrialization: By incentivizing domestic manufacturing, reshoring supply chains, and attracting foreign direct investment, Trump aims to reverse U.S. deindustrialization. Historically, protectionism—rooted in Alexander Hamilton’s policies [10] and sustained through the U.S. industrial rise—has proven effective for economies with large domestic markets. With foreign trade comprising only 25% of U.S. GDP (versus Germany’s 83%), [11] the U.S. is well-insulated from retaliatory tariffs, enhancing the viability of this approach. Comparative historical successes in South Korea, Japan, China, and Germany reinforce this strategy’s potential.

Financing Tax Cuts: Trump pledged to reduce income taxes and cut the corporate tax rate from 21% to 15%, building on his 2018 reduction from 35%, which will massively boost the comparative locational advantages in the U.S. [12] Unlike Germany’s 30% combined corporate tax rate, [13] Trump’s approach taxes foreign entities rather than U.S. businesses.

Funding relies on:

- Reducing wasteful spending, with Elon Musk leading the Department for Government Efficiency (DOGE).

- Boosting tariff revenue from $79 billion in 2024 (1.2% of government expenditure) to $600 billion annually (9%), a seven-and-a-half-fold increase. [14]

Addressing Fiscal Challenges: Despite this revenue surge, tariffs alone cannot offset defence spending ($841 billion) and net interest payments ($882 billion), which together account for 26% of the budget. [15] With only three surplus years in 45 (2000–2003), U.S. debt has soared to 127% of GDP ($36 trillion) by 2025, necessitating broader fiscal strategies. [16]

- Defense Secretary Pete Hegseth advocates raising allied defense spending from NATO’s 2% GDP target to 5%, shifting burdens from U.S. taxpayers. [17] This aligns with Trump’s broader alleged “burden-sharing” agenda.

- Net interest payments, a growing budgetary strain, complicate tax cut financing. Issuing new debt—potentially pushing debt to 143% of GDP—requires lowering interest rates on new obligations. Nearly a quarter of U.S. debt is held by foreign entities, including Germany (nearly USD 100 billion in Treasury bills). [18] Increasing foreign demand for U.S. bonds, however, would strengthen the dollar, undermining reindustrialization by making exports costlier and imports cheaper.

The Mar-a-Lago Accord

Trump’s tariffs are a prelude to a broader strategic framework: the "Mar-a-Lago Accord," echoing the 1985 Plaza Accord. Proposed by Stephen Miran—now Chair of the Council of Economic Advisers—in November 2024 while at Hudson Bay Capital, it targets the dollar’s overvaluation and allied burden-sharing. [19]

Objectives and Mechanisms

Dollar Devaluation and Cheaper Borrowing: The dollar’s reserve status, [20] while enabling cheaper borrowing and sanctions enforcement, erodes manufacturing by inflating export costs. Miran argues its "exorbitant privilege" (per Valéry Giscard d’Estaing) now exacts a steep industrial toll. The Mar-a-Lago Accord seeks not only to devalue the dollar to restore export competitiveness but also to lower interest rates on government debt, providing the U.S. government with greater fiscal space to reduce domestic income and corporate taxation. This dual-purpose strategy involves:

- Pressuring foreign creditors (e.g., Germany, with nearly USD 100 billion in Treasury bills) to convert holdings into ultra-long-term "century bonds" (e.g., 100-year maturities) with minimal interest, reducing short-term dollar demand and easing refinancing costs to make government borrowing cheaper. [21]

- Potentially forcing euro revaluation via central bank coordination or EU fiscal commitments, further supporting dollar devaluation while alleviating the fiscal burden of high interest payments.

Allied Burden-Shifting: Allies like Germany are urged to raise defence spending to 5% of GDP, with threats of U.S. military withdrawal from Europe—using the alleged Russian threat, amplified by a European warmongering political class and media.

Geopolitical Strategy

Publicly framed as "equitable burden-sharing," the accord aims to entrench U.S. dominance. Allies would finance U.S. debt via century bonds and higher defence contributions, easing fiscal pressures while revaluing currencies to boost U.S. exports. Critics view this as a "perfidious strategy" deepening European financial dependency, compelling nations like Germany to pay an economic tribute to sustain the waning U.S. empire.

Conclusion

Trump’s tariff hammer and the Mar-a-Lago Accord form a strategic triad—protectionism, fiscal relief, and geopolitical leverage—to reboot U.S. hegemony. Addressing deindustrialization, a 127% GDP debt, and military overextension hinges on correcting the dollar’s overvaluation, which tariffs, and the accord seek to negotiate down. Trump’s "America First" genius, far from being ignorant or mentally unfit, lies in wielding economic and military tools with calculated determination.

For Germany and European patriots this poses a dilemma. While Trump aligns culturally against globalist ideologies, his policies burden allies economically, demanding concessions under fairness pretexts. Germany must eschew illusions of mutual benefit, instead forging a "Germany First" path—restoring sovereignty, industry, and independence from Brussels and Washington through strategic self-reliance, inspired by Trump’s model yet distinct in execution.

1. JUNGE FREIHEIT. (2025). Mit diesen Zöllen überzieht Trump die ganze Welt. Available at: https://jungefreiheit.de/politik/ausland/2025/mit-diesen-zoellen-ueberzieht-trump-die-ganze-welt/

2. European Parliament (2025). Handel zwischen der EU und den USA: mögliche Auswirkungen neuer Zölle auf Europa. URL: https://www.europarl.europa.eu/topics/de/article/20250210STO26801/handel-zwischen-der-eu-und-den-usa-mogliche-auswirkungen-neuer-zolle-auf-europa

3. European Commission (2024). Wichtigste Partner der EU im internationalen Handel. URL: https://ec.europa.eu/eurostat/de/web/products-euro-indicators/w/2-04072024-bp#:~:text=Quelle:%20EZB-,Wichtigste%20Partner%20der%20EU,Euro)%20registriert

4. ING (2025). EU-US Trade Strategy. URL: https://think.ing.com/articles/eu-us-trade-strategy/

5. EU-US Trade Strategy. URL: https://think.ing.com/articles/eu-us-trade-strategy/

6. Ho L.S. (2025). Overvalued US dollar damaging world economy. China Daily Global. . URL: https://global.chinadaily.com.cn/a/202502/06/WS67a40e60a310a2ab06eaa630.html

7. The White House (2025). Fact Sheet: President Donald J. Trump Declares National Emergency to Increase Our Competitive Edge, Protect Our Sovereignty, and Strengthen Our National and Economic Security. URL: https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-declares-national-emergency-to-increase-our-competitive-edge-protect-our-sovereignty-and-strengthen-our-national-and-economic-security/

8. Ghodsi M. at al. (2024). Can Multinationals Withstand Growing Trade Barriers? wiiw. Available at: https://wiiw.ac.at/can-multinationals-withstand-growing-trade-barriers-p-6732.html

9. Abbyad N. and Herman P. (2017). How Much Do Non-Tariff Measures Cost? A Survey of Quantification Methods. U.S. International Trade Commission (USITC). Available at: https://www.usitc.gov/publications/332/201705c_ntmsurvey.html

10. Guardian (2018). Edward III and Alexander Hamilton: The History of the Biggest Protectionists. URL: https://www.theguardian.com/business/2018/mar/10/edward-iii-alexander-hamilton-history-biggest-protectionists

11. World Bank (2025). Trade (% of GDP). URL: https://data.worldbank.org/indicator/NE.TRD.GNFS.ZS?locations=US-DE

12. Tax Foundation (2025). Donald Trump Tax Plan 2024. URL: https://taxfoundation.org/research/all/federal/donald-trump-tax-plan-2024/

13. Tax Foundation (2024). Corporate Tax Rates by Country, 2024. Available at: https://taxfoundation.org/data/all/global/corporate-tax-rates-by-country-2024/

14. Center for Strategic and International Studies (2025). Liberation Day: Tariffs Explained. URL: https://www.csis.org/analysis/liberation-day-tariffs-explained

15. Congressional Budget Office (CBO). (2025). Summary for Fiscal Year 2024. Available at: https://www.cbo.gov/publication/60843/html

16. Bales S. (2025). Zinsen, US-Staatsverschuldung und die Politik von Donald Trump: ein Balanceakt. KfW Research. Available at: https://www.kfw.de/%C3%9Cber-die-KfW/Newsroom/Aktuelles/News-Details_843776.html

17. Lopez C.T. (2025). Hegseth Tells NATO Hard Power Provides Deterrence, Defense. U.S. Department of Defense. Available at: https://www.defense.gov/News/News-Stories/Article/article/4066810/hegseth-tells-nato-hard-power-provides-deterrence-defense/

18. Federal Reserve, US Department of the Treasury. (2025). Major foreign holders of United States treasury securities as of December 2024 (in billion U.S. dollars). URL: https://www.statista.com/statistics/246420/major-foreign-holders-of-us-treasury-debt/

19. Miran S. (2025). A User’s Guide to Restructuring the Global Trading System. Hudson Bay Capital. URL: https://www.hudsonbaycapital.com/documents/FG/hudsonbay/research/638199_A_Users_Guide_to_Restructuring_the_Global_Trading_System.pdf

20. Buchholz K. (2025). U.S. Dollar Defends Role as Global Currency. Statista. Available at: https://www.statista.com/chart/30838/share-us-us-dollar-in-global-economy-global-financial-transactions/

21. Kraemer M. (2025). Mar-a-Lago Accord. LBBW. URL: https://www.lbbw.de/artikel/klartext/mar-a-lago-accord_ajth4e1ggc_d.html